In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup. Live alerts are sent to Traders Hub members only.

Stock Market Update

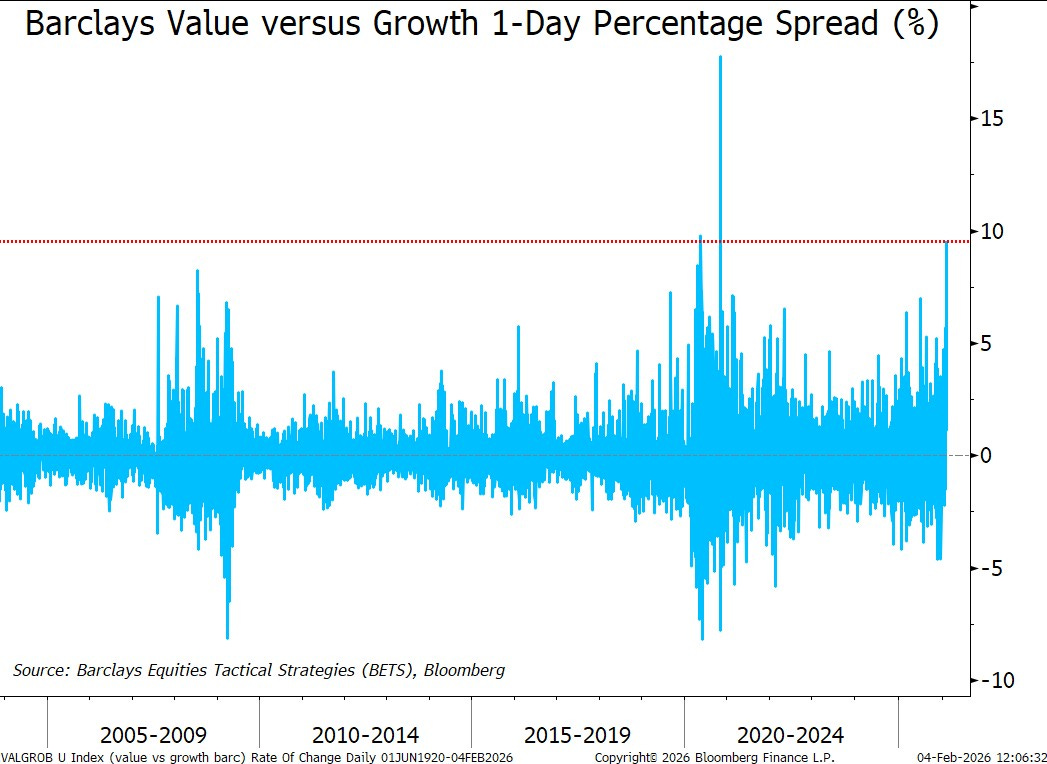

A major stock market rotation is playing out as new leadership emerges in key sectors leveraged to the economy. Many stocks exposed to the growth and artificial intelligence (AI) theme are pulling back sharply, with the downside accelerating in Wednesday’s trading session. Many of the most vulnerable to the downside rank highly based on the momentum and growth factors utilized by quantitative investors, which seeks out stocks showing high growth fundamentals, relative strength, and have performed well over intermediate-term time frames. By one estimate, growth stocks had one of their worst days ever relative to the value (chart below).

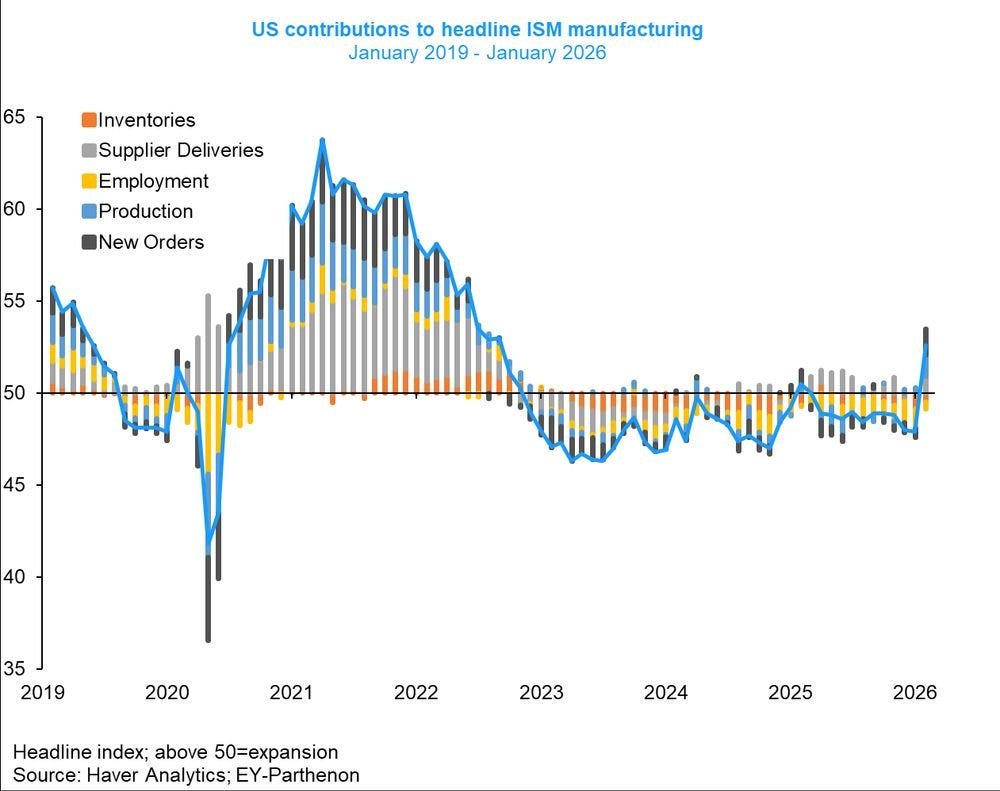

While the selloff in mega-cap growth and AI stocks in weighing on the major indexes like the S&P 500 and Nasdaq, it’s not exactly a “risk off” move taking place. Instead, there has been a significant rotation into the average stock including cyclical sectors leveraged to the outlook for the economy. While the S&P 500 dropped by 0.5% in yesterday’s trading, more than 70% of the stocks in the index advanced on the day. Meanwhile ETFs tracking transportation stocks, banks, industrials, and energy all moved out to new record highs. That comes on the heels of the ISM Manufacturing PMI for the month of January that rose to its highest level in four years (chart below) with the leading new orders component surging to its best level since early 2022.

The combination of recent economic reports and performance of cyclical sectors continues painting a positive picture on the outlook. Given those developments, investors may be questioning the collectively elevated valuations in the S&P 500 and its largest holdings if the interest rate outlook is in question. The action so far in 2026 also shows the growing risks of index investing and why a more active approach is needed to navigate the market.

Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.