In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup. Live alerts are sent to Traders Hub members only.

Stock Market Update

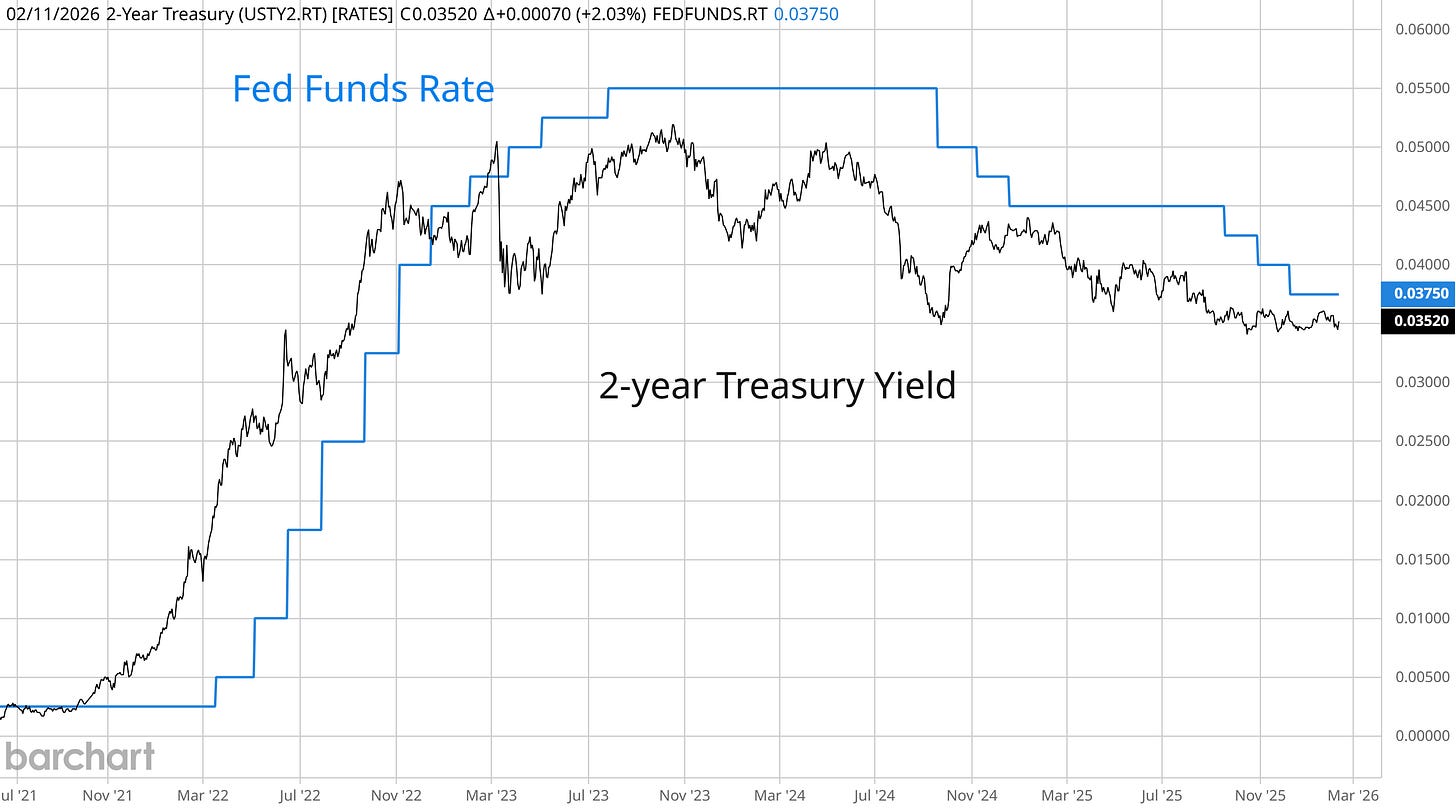

A stronger than expected payrolls report is driving a mixed reaction in the stock market and keeping a bullish rotation theme in play. The January payrolls report showed that 130,000 jobs were created during the month which was significantly above expectations for an addition of 55,000. The unemployment rate also ticked lower to 4.3% from 4.4% in the previous report. The initial “risk on” reaction across the market was quickly reversed as investors were reminded of the impact on the interest rate outlook. Following the report, the 2-year Treasury yield jumped to 3.52%, which is the lower end of the current range for the fed funds rate (chart below). In other words, the bond market doesn’t expect any further rate cuts for now.

The interest rate outlook is critical to supporting market valuations, particularly in growth sectors. Collectively, large-cap growth stocks trade at a forward price-to-earnings ratio of 27.6, which is 39% above the 20-year average. Growth stocks, whose earnings potential exists further into the future, are the most vulnerable to the discounting mechanism to determine the present value of forward earnings. But it’s not all bad news, as more evidence of a strong economy supports the earnings outlook especially for cyclical sectors. Median earnings growth for stocks in the Russell 3000 (a broad index) has been accelerating since the start of 2025 (chart below), which supports the broadening rally.

A rally into cyclicals and the average stock has been a key feature of the market action since the start of the year, with today’s payrolls report providing another rotation catalyst. While indexes and related ETFs are vulnerable due to their heavy allocation in growth and AI stocks, there are plenty of trade setups and breakouts occurring across the market.

Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.