In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

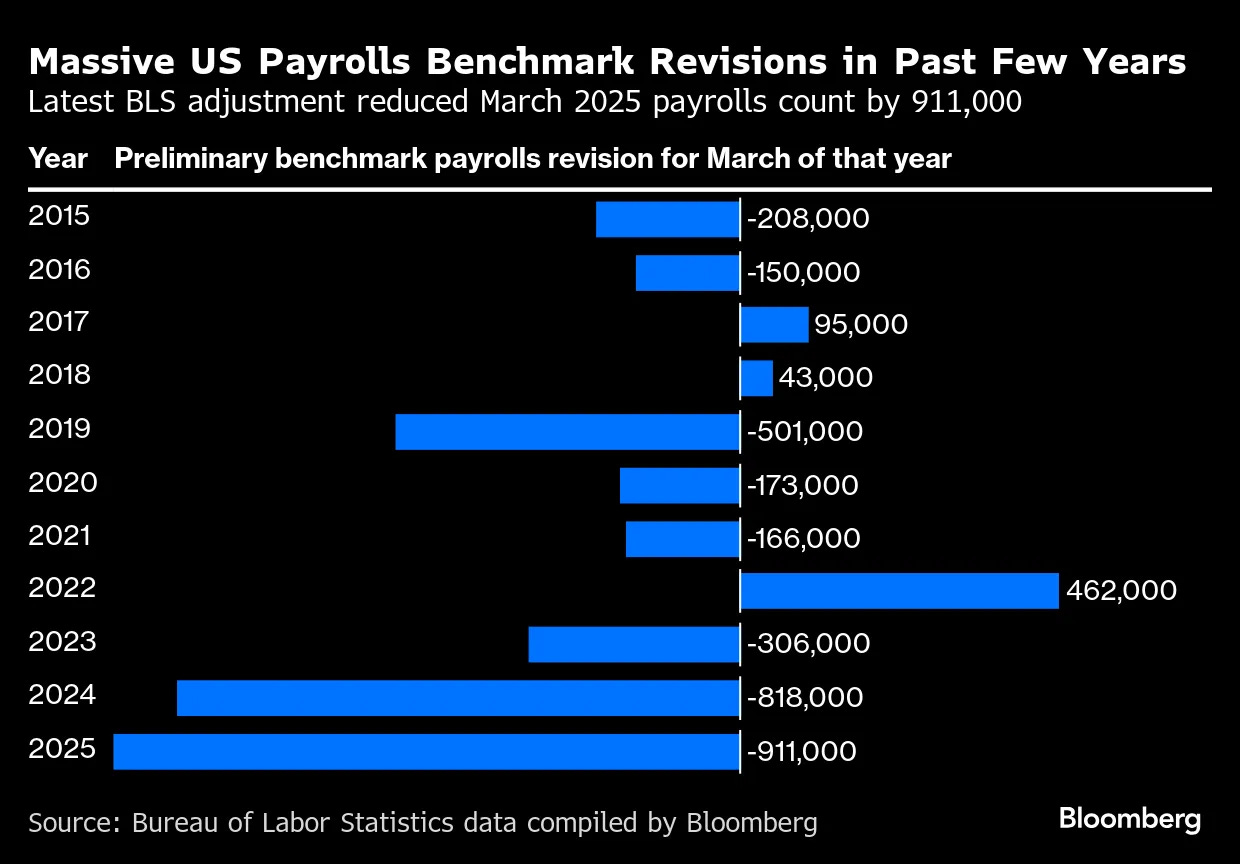

A soft producer inflation report and a record downward revision to job growth is pressuring the Federal Reserve to deliver on interest rate cuts. Following a big upside surprise for July, the Producer Price Index (PPI) showed producer inflation falling 0.1% in August compared to July versus expectations for a gain of 0.3%. The core PPI that excludes food and energy rose by 2.8% on a year-over-year basis. Cooler producer inflation also comes on the heels of a weak August payrolls report and massive negative revision to the initial payrolls estimate for the 12 month period ended in March. The Bureau of Labor Statistics made a preliminary benchmark payrolls revision that reduced job growth by a record 911,000.

That sets the stage for the Fed to resume interest rate cuts when officials from the central bank meet next week. Market-implied odds currently favor a quarter point reduction along with a slight chance of a larger 0.50% cut. Odds now point to six 0.25% cuts over the coming year, although the 2-year Treasury yield is implying three to four cuts from the current level of fed funds which sits at 4.25-4.50%. While investors are optimistic about the chances for rate cuts, recent weakness in labor market data is stirring fears on the underlying health of the economy.

It’s worth noting that leading indicators of economic activity are picking up, like the new orders component in business surveys. The stock market is also being supported with strong underlying breadth, where the NYSE cumulative advance/decline line is making a new high ahead of the S&P 500 (chart below). That shows strong participation by the average stock despite frequent headlines about narrow market leadership. Once the Fed starts cutting rates again, the forward path for the S&P 500 will come down to the economy avoiding recession or not.

The combination of improving leading indicators, ongoing loose financial conditions, and strong market breadth that includes participation by cyclical industries favors an ongoing economic expansion in my opinion. That supports the earnings outlook which is ultimately good for stock prices at the same time the Fed is set to resume rate cuts. That could make for an excellent trading environment into next year.

Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.