In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

You can sign up for a 7-day free trial here to unlock the trade ideas in this report.

Stock Market Update

An updated look at key inflation reports has investors breathing a sigh of relief. The Producer Price Index (PPI) hit first this week, and revealed a 3.3% year-over-year gain in the headline figure for the month of December while the core figure that strips out food and energy rose by 3.5%. Both figures accelerated from the prior month, but came in less than expected. Next came the Consumer Price Index (CPI) for December. While the headline figure matched expectations with a 2.9% gain, the core CPI rose by 3.2% which was below estimates and is a slight deceleration from November’s pace. The chart below shows the yearly gain in both headline CPI (red line) and PPI (blue line).

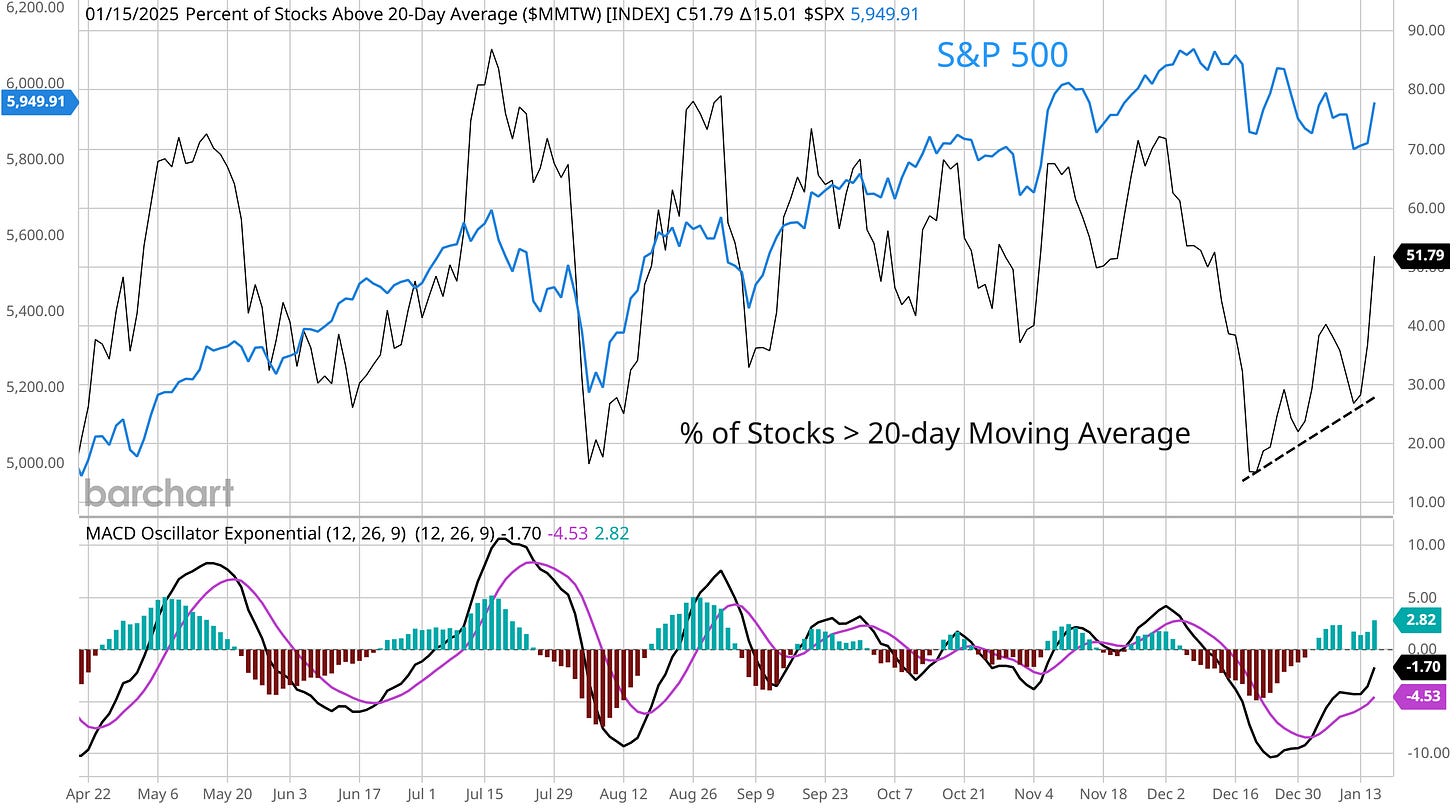

While PPI is still pointing the way higher after crossing above CPI in November, the softer core CPI gave investors a reason to cheer. And while the inflation report might be driving the narrative behind yesterday’s rally, conditions have been developing over the past couple weeks to drive a rebound in stocks. As I noted recently, a combination of bearish investor sentiment coupled with positive breadth divergences are powerful ingredients to fuel a rally. The AAII survey of retail investor sentiment most recently showed bulls dropping for the third straight week to the lowest level since last April. The bull-bear spread also went negative for just the third time since November 2023. At the same time, the average stock was showing a significant trend improvement even as the S&P 500 was pulling back. The chart below shows the percent of stocks across the market trading above their 20-day moving average (MA). Just before the S&P’s post-CPI rally, the dashed line shows the rise in stocks trading in short-term uptrends even as the S&P 500 was pulling back.

As I reviewed in this week’s Market Mosaic, I continue to believe the weight of the evidence points to accelerating inflation as 2025 gets underway. But I also expect the bull market to push forward as a strong economy delivers a boost to the corporate earnings outlook. The latest round of favorable anecdotal data came from bank earnings reports. JPMorgan Chase (JPM) reported a record annual profit while fourth quarter earnings jumped 58%. The bank also noted business optimism around the economy. A jump in bank shares are among our open positions seeing a boost from the rally.

Keep reading below to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.