In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

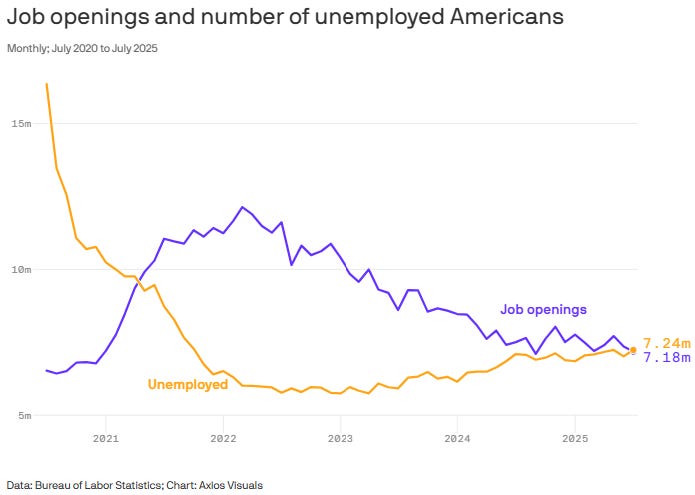

Labor market data being released this week will be a major catalyst on the outlook for rate cuts. While investors wait for Friday’s payrolls report for the month of August, there are more signs of a weakening labor market following the July payrolls miss and massive downward revisions to May and June. In the Job Openings and Labor Turnover Survey report this week, it showed more unemployed workers than job openings for the first time since 2021 (chart below). That pushed odds for a quarter-point rate cut to nearly 96% at the next Federal Reserve meeting later this month.

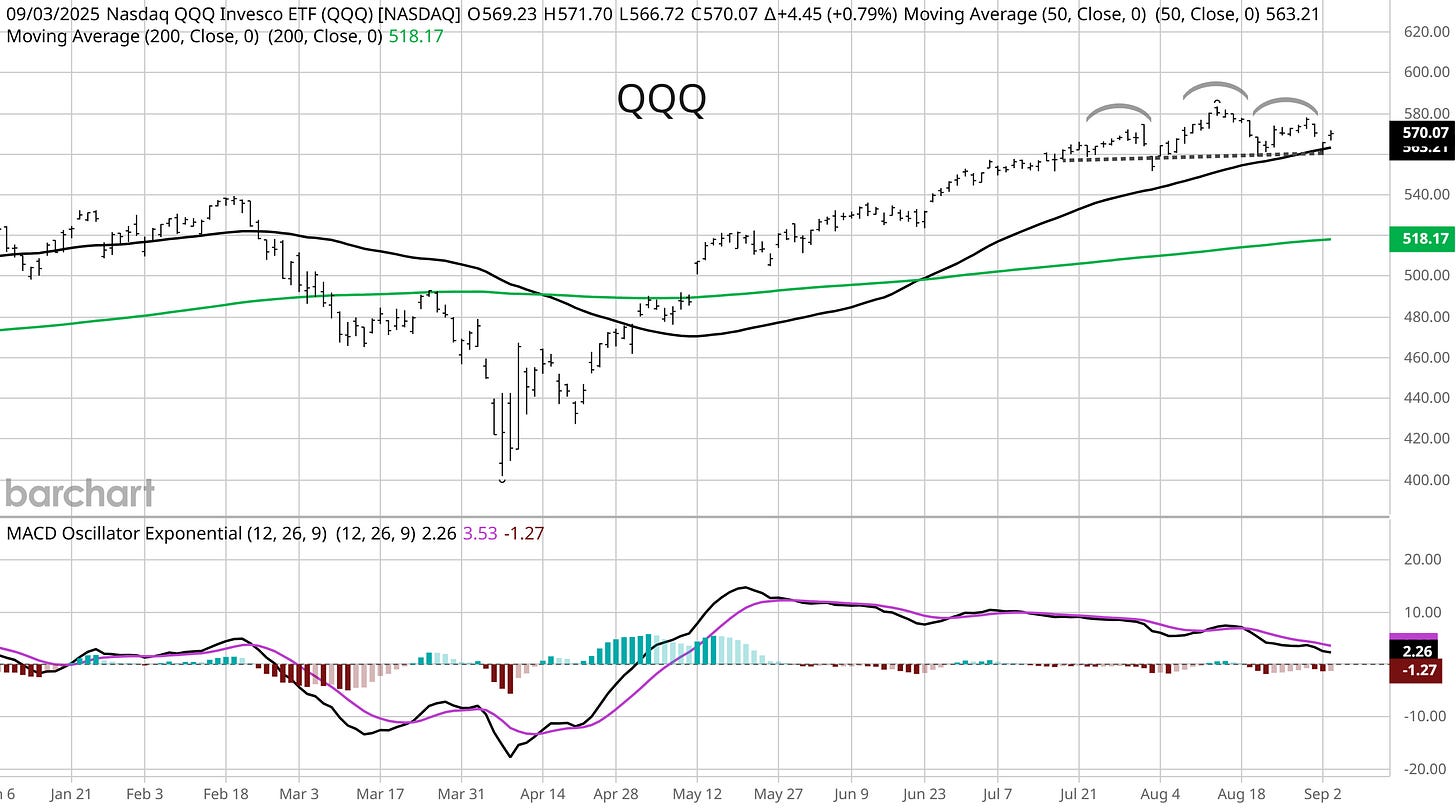

While odds for a rate cut appear locked in (pending no huge upside surprise in August payrolls), the Fed could still be facing a “one and done” scenario on reducing rates. That’s because of evidence that inflationary pressures continue building with inflation-sensitive areas of the capital markets moving higher. Gold prices are building on their breakout from a four-month consolidation and is hitting a new record high just below the $3,600 per ounce level. The 30-year Treasury yield is also on the cusp of breaking out over the 5.0% level, which has served as resistance in an ascending triangle pattern extending back to 2023. Accelerating inflation could limit the Fed’s ability to loosen monetary policy, which would weigh on expensive mega-cap growth stocks including the “Magnificent 7”. The Invesco QQQ Trust, Series 1 (QQQ) tracking the Nasdaq-100 Index will be key to watch this week. QQQ recently tested the neckline of a head and shoulder’s topping pattern, which is also at the 50-day moving average. A loss of that level would signal more downside ahead.

While a pullback in growth stocks would weigh on the major cap-weighted indexes given their heavy allocation, recent strong breadth shows the average stock is holding up. A rotation into the average stock could persist if evidence suggests economic growth is picking up and labor market weakness looks temporary.

Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.