In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

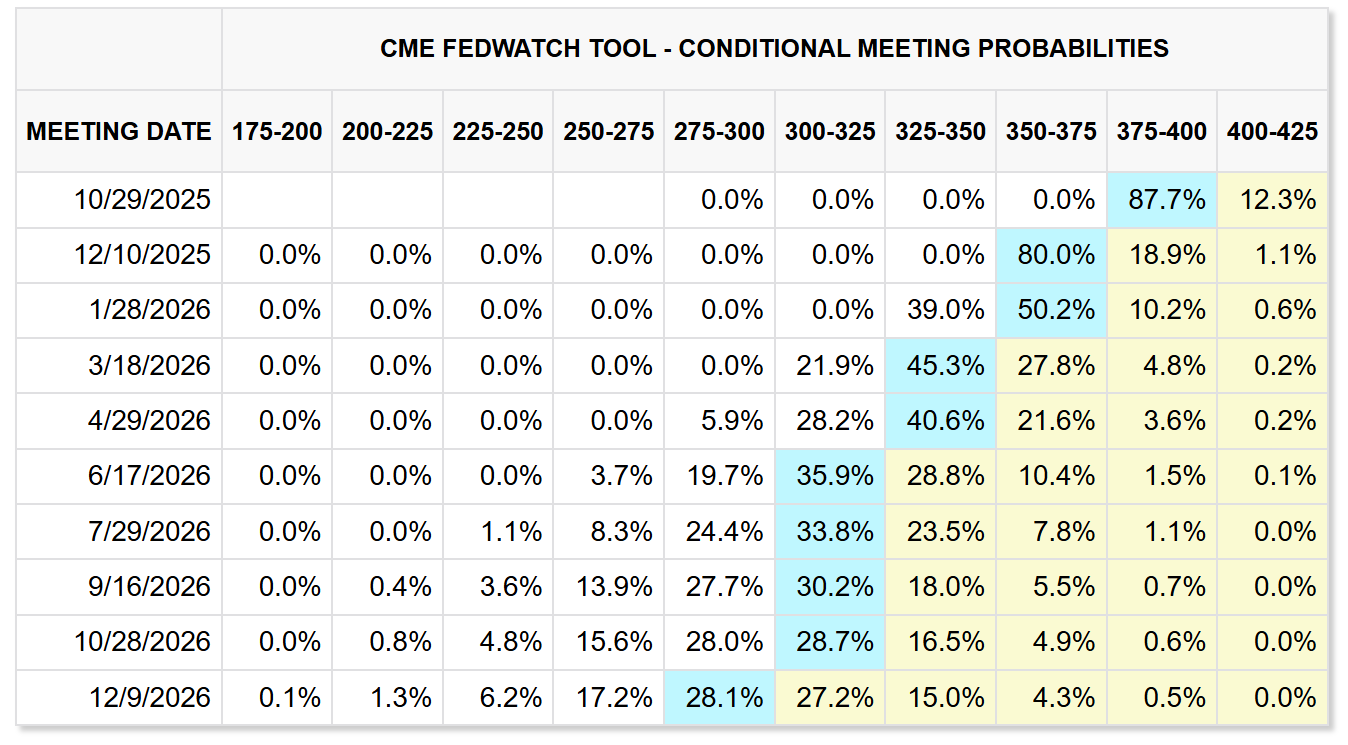

Following a nine month pause, the Federal Reserve is restarting its easing campaign by cutting interest rates for the first time since December. The 0.25% reduction to the fed funds rate was widely expected following Fed Chair Powell’s Jackson Hole speech in August that shifted the Fed’s focus to supporting the labor market. A dismal payrolls report and massive negative annual revision to initial payrolls estimates set the stage for the Fed to start cutting rates once again. The only question now is the pace and magnitude of future rate cuts. During his post-meeting press conference, Powell commented that the Fed is in a “meeting-by-meeting situation". Current market-implied odds point to five additional quarter-point cuts through the end of next year (chart below).

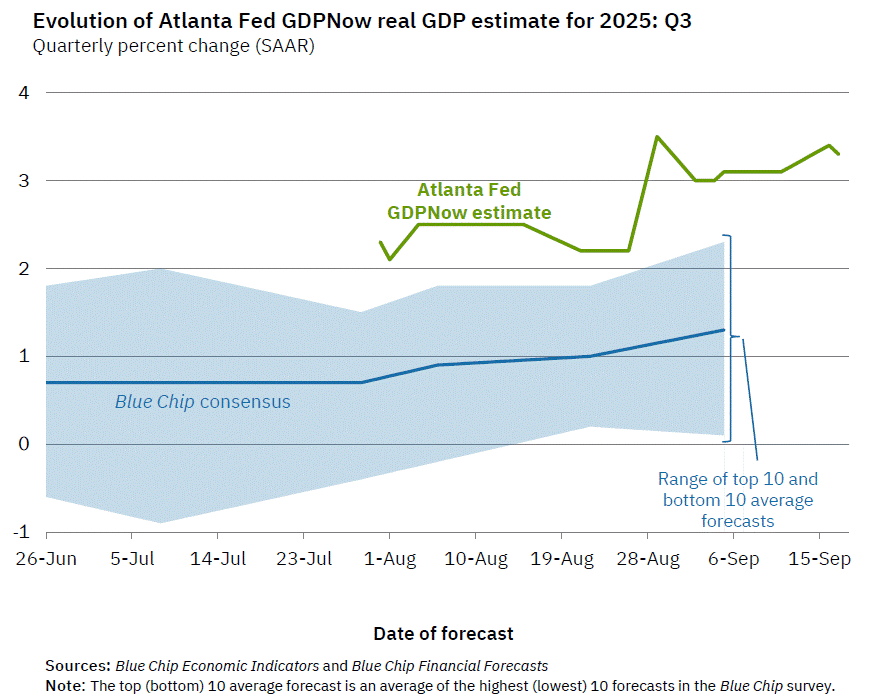

The Fed’s Summary of Economic Projections shows officials expecting two more cuts this year, while inflation isn’t expected to return to the Fed’s 2% target until 2028. While I’ve detailed how building inflationary pressures could ultimately limit how much the Fed can cut rates, it appears there is more easing in the pipeline while financial conditions are already much looser than average. It’s also worth recalling that labor market data is a lagging indicator, and could just now be reflecting a growth scare from earlier in the year when the S&P 500 briefly dropped into bear market territory. Now the index is hovering near record highs while evidence points to an accelerating economy. The August retail sales report showed retail sales rising 5% compared to last year, which helped boost the Atlanta Fed’s GDPNow forecast of current quarter annualized GDP growth to 3.3% (chart below).

The Fed cutting rates into a strengthening economy along with loose financial conditions could easily drive the bull market higher into next year. Strengthening breadth with expanding participation by the average stock is another sign that the rally’s foundation remains strong. We’ve made several new additions to the model portfolio, while more breakouts in high growth stocks are looming.

Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.