In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

The minutes of the Federal Reserve’s most recent rate-setting meeting shows a divided central bank regarding the outlook for more interest rate cuts. A statement in the minutes noted that most “judged that it likely would be appropriate to ease policy further over the remainder of the year.” The primary question is if the Fed would implement a quarter point cut at its two remaining meetings for 2025. While a slight majority (10 versus 9) favors a cut at each meeting, it remains clear that the Fed is staying on the easing path for now.

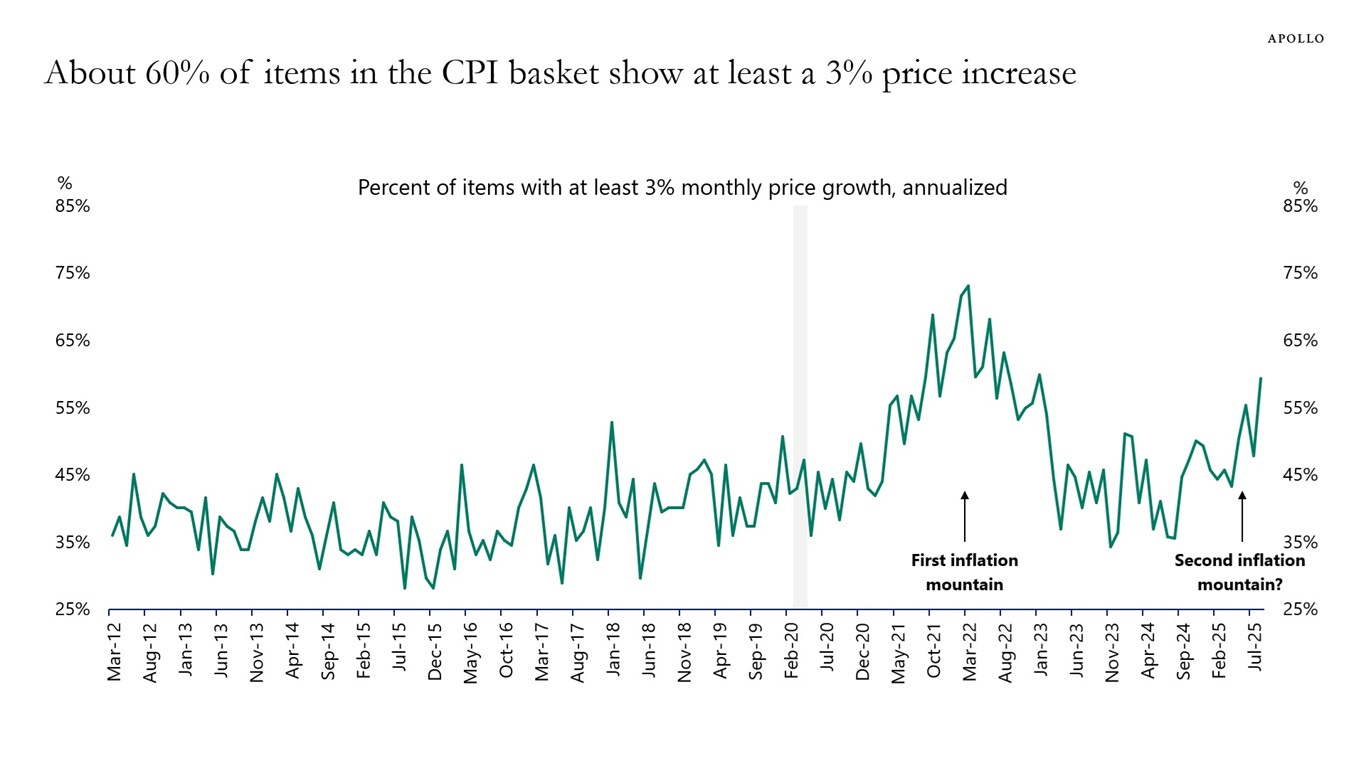

The outlook for further rate cuts is remarkable given the current level of inflation, with several core consumer measures holding near 3%. That’s well above the Fed’s 2% target, with the FOMC minutes commenting that progress on inflation “had stalled, even excluding the effects of this year’s tariff increases.” The chart below shows the percent of items in the Consumer Price Index (CPI) basket showing at least a 3% increase. That figure stands at about 60%, and has been accelerating for the past year.

The prospect of more rate cuts could be problematic for inflation in the months ahead, but also a tailwind for the rally in risk assets for now. As long as inflation doesn’t accelerate above 3% too quickly (in order to keep the Fed on track), more rate cuts at a time when financial conditions are already loose and economic growth appears strong is very supportive of the earnings outlook. Second quarter GDP was recently revised to 3.8% annualized growth, with the Fed’s GDPNow model holding at 3.8% for the third quarter as well (although this estimate is now being impacted by delayed data from the government shutdown). While we’re still waiting for the September payrolls report, an estimate of job growth from Goldman Sachs suggests that labor market could be reaccelerating (blue line in the chart below).

The converging factors of rate cuts, loose financial conditions, and evidence of a solid economy is making this a constructive trading environment. This week, we closed two positions for gains of 244.4% on the PL January 16 $10 Calls and 165.4% on the GLXY October 17 $30 Calls. I have updates to the model portfolio and chart analysis for new trade ideas below.

Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.