Welcome back to Mosaic Chart Alerts!

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of fundamentals along with a proper chart setup.

Here are my notes from a focus list of setups I’m monitoring.

Stock Market Update

No big surprises were in store following the latest Federal Reserve meeting. The Fed raised interest rates another 0.25% (fed funds now the highest since 2001 in the chart below from Liz Ann Sonders) as expected, while chair Jerome Powell emphasized that the future path of rate hikes will be data dependent. Powell also made clear the lag effect of policy decisions, and that the full brunt of rate hikes remains to be seen. That means even if the moderating pace of inflation slows and trailing measures of economic activity remain solid, the Fed is likely on the sidelines for now.

So for investors and traders, the bigger picture focus should be with earnings season and forward guidance. The stock market can keep building positive momentum despite higher rates, but it will take a strong earnings recovery. I talked earlier this week about some of the forces at play that could boost the economy and support the earnings picture. There’s $27 trillion in combined market capitalization reporting this week, and with a lot more in the pipeline. The key is to watch how forward estimates evolve across the market.

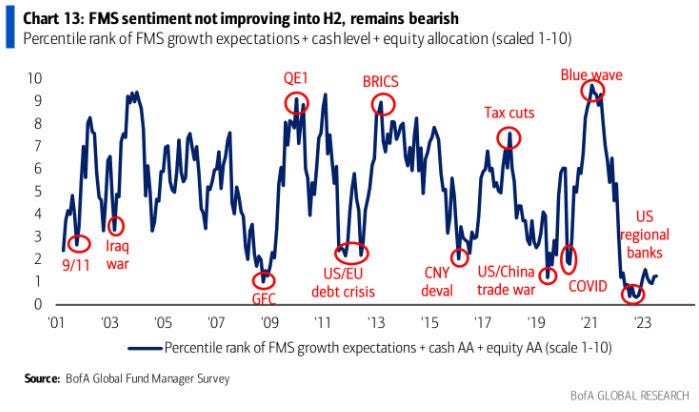

Aside from the macro picture, concerns are mounting over signs of too much bullishness among investors. You’re seeing that show up in places like sentiment surveys and option markets. The AAII’s survey of retail investors shows bullish sentiment at the highest level in over two years, while call option volumes are hitting extreme levels. But there’s still plenty of skepticism out there. Among a survey of Wall Street strategists, only 17% expect the S&P 500 to finish the year higher than current levels. And for fund managers with money on the line, they collectively remain bearish on equity exposure as you can see below from BofA’s Fund Manager Survey.

A pullback will happen at some point, but evidence from breadth indicators would suggest nothing more than a pause within the uptrend. The turnaround in the performance of the average stock continues showing up in metrics like net new highs, which means I’m continuing to focus on breakout setups for new positions. For this week, I’m removing ENVA from watch as the stock moves above resistance to complete its pattern. I’m also removing LTH following a drop in the stock after earnings. That means I have a couple new additions this week.

Keep reading below for all the updates…

Long Trade Setups

ONON

The basing pattern is not as tight as I prefer, but similar to an ascending triangle going back to the May peak. Choppy price action since attempting to breakout a couple weeks ago, but now starting to firm up on the move over $35.

TX

Massive consolidation base going back nearly two years. Watching for a move over $45, followed by a test of the prior highs around $52. Would prefer to see the MACD reset near zero before attempting a breakout.

HGBL

Took this chart back to 2020 to show the importance of the $4 area. That prior high was tested recently, with the stock now pulling back since late June. That’s resetting the MACD at the zero line, which is trying to turn higher. Looking for a move over $4.15. More volatile small-cap name, so position size accordingly.

MOMO

Consolidating since January as part of an overall bottoming base. Looking for a move over $10-11 to signal the start of the next move higher. Recent MACD reset at zero is constructive as well.

IOT

Price rallied to the post-IPO highs around $30. Still pulling back from that level, with the MACD resetting at zero but the relative strength (RS) line starting to weaken. A breakout over $30 with the RS line at a new high and the MACD turning up from zero is my ideal trade scenario.

NABL

Another recent IPO testing the prior highs around $15.50. Prefer to see the stock hold the $14 support level while it consolidates. Watching for a breakout over $15.50 with the RS line confirming to new highs.

SKX

Tested the highs from 2021 at the $55 resistance level and pulled back toward the 50-day moving average. The $50 level is also good support from a prior breakout. Looking for a move to new highs, and don’t want to see $50 give way.

CIVI

Energy exploration and production company trying to move out of this triangle pattern. Price is moving above trendline resistance, and now watching for new all-time highs.

Short Trade Setups

None this week!

Rules of the Game

I trade chart breakouts based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

I also use the RS line as a breakout filter. I find this improves the quality of the price signal and helps prevent false breakouts. So if price is moving out of a chart pattern, I want to see the RS line (the green line in the bottom panel of my charts) at new 52-week highs. Conversely, I prefer an RS line making new 52-week lows for short setups.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this post.