Welcome back to Mosaic Chart Alerts!

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of fundamentals along with a proper chart setup.

Here are my notes from a focus list of setups I’m monitoring.

Stock Market Update

During a three month span starting at the end of July, the S&P 500 fell into correction territory with a 10% decline. Its taken less than one month for the index to recover nearly all the losses. The S&P is less than 1% away from this year’s high, while the Nasdaq 100 is making fresh year-to-date highs this week. But the key feature behind the rally since late October is breadth expansion. In my most recent Market Mosaic, I highlighted additional breadth thrusts emerging last week. We’ve also seen new 52-week highs start outpacing new 52-week lows across the stock exchanges. You can see the cluster of net new highs in the chart below, which is more evidence of growing participation in this rally. Along with breadth thrusts, that signals buying activity among institutional investors which is needed to sustain the advance.

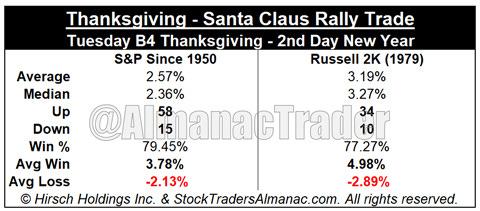

Stronger performance among the average stock is also hitting at just the right time. The Thanksgiving holiday-shortened week kicks off one of the most favorable seasonal stretches for the stock market. The start of November marks the end of “sell in May and go away”, with a historically positive six month period just getting started. Within that time frame, returns through January are particularly strong. And when you combine that with December’s Santa Claus rally, the calendar period starting yesterday and running through the start of the New Year really stands out. The table below (h/t AlmanacTrader) shows stats since 1950 for that stretch, with the S&P 500 gaining nearly 80% of the time while average returns from small-caps top 3%.

I still maintain that stocks could benefit from a pause here by trading sideways or retracing a portion of the gains seen in the past month. Momentum across the major indexes and many stocks on my watchlist is becoming more extended, where a pullback would also help many of my watchlist setups complete their chart pattern. But I expect any pullback to be in the context of a broader uptrend, with breadth confirmation and positive seasonality able to sustain the stock market’s advance for now. For this week, I’m removing GHM from the watchlist as the stock breaks out from its pattern, while I have a couple new additions as well.

Keep reading below for all the updates…and Happy Thanksgiving!

Long Trade Setups

MBLY

Making a quick move higher over the past month off support around $34. My ideal trade setup is price tests resistance around $45 then does a small retracement of the rally. Look for MACD to reset at zero in that scenario, followed by an attempt to breakout over $45.

SN

Recent IPO basing in a tight range since September, creating a resistance level around the $46 area. Moving over that level today on increasing volume, with the MACD turning up from the zero line. The relative strength (RS) line staying near its high.

LI

Price starting to rally again after testing the post-IPO highs around $45. In an ideal setup, price trades sideways to reset the MACD at the zero line. That sets up a breakout over $45, which should see rising volume and confirmation with the RS line at new highs.

AGI

If gold prices can breakout, AGI is a top miner on my list. The MACD is turning up from the zero line. Watching for a breakout over $13.50 and prefer to see the RS line at new highs.

GES

Pulling back after reporting earnings. Will keep on the watchlist for now as long as support at $20 holds. Still watching resistance at $25, which is a level tested several times going back to 2021. Series of higher lows since last October’s bottom. A breakout could target the prior high near $29.

AXON

Creating a resistance level just below $230 going back to March. Price also making a series of higher lows since July. MACD turning up from the zero line and a recent cluster of large volume. Prefer to see the RS line make a 52-week high on a breakout.

RNR

Basing since February while creating a resistance level around the $220 area. Recent attempt to breakout although the RS line did not confirm. MACD now resetting at the zero line. Want to see $200 hold on any pullback.

YELP

Trading in a bullish flag pattern following the rally from $27 in May. Looking for a move above trendline resistance around $45. The RS line is staying close to 52-week highs.

URNM

Uranium stocks could be basing for another move higher. The URNM uranium ETF is rebounding after pulling back to the 50-day MA. That pullback allowed the MACD to reset. Watching for a breakout over $50 with the RS line at new highs.

NVGS

Price firming up in a base that extends back over a year. Making a run toward resistance around the $15 level. MACD in a good position to support a breakout, with trendline resistance being tested recently.

Short Trade Setups

None this week!

Rules of the Game

I trade chart breakouts based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

I also use the RS line as a breakout filter. I find this improves the quality of the price signal and helps prevent false breakouts. So if price is moving out of a chart pattern, I want to see the RS line (the green line in the bottom panel of my charts) at new 52-week highs. Conversely, I prefer an RS line making new 52-week lows for short setups.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this post.