Welcome back to Mosaic Chart Alerts!

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Here are my notes from a focus list of setups I’m monitoring.

Stock Market Update

Following the Federal Reserve’s decision to cut interest rates by 0.50% last week, attention has turned toward how various asset classes and sectors of the stock market perform historically following the first rate cut. I’ve made it clear that I’m favoring an economic path forward that avoids a recession (for now). That view is driven by things like already loose financial conditions as the Fed starts easing monetary policy, and positive signs coming from areas like high yield bonds and even individual stocks with Caterpillar’s recent breakout that I covered here.

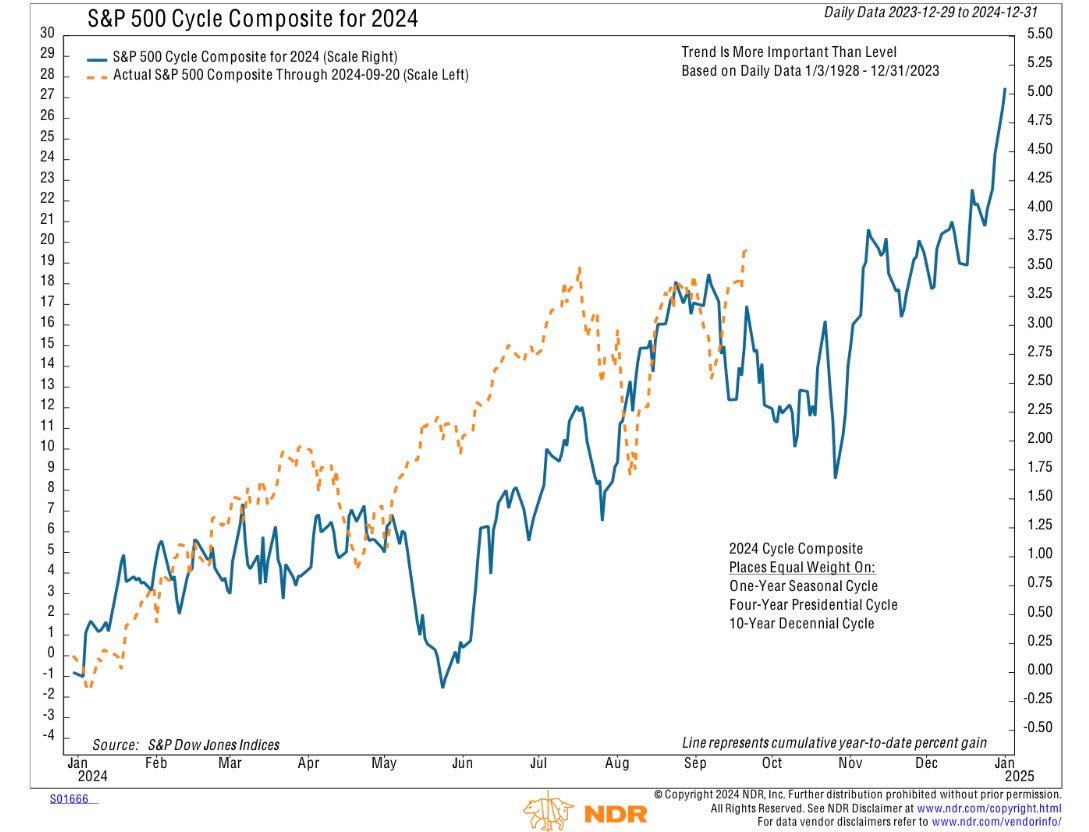

But that doesn’t mean there won’t be bumps along the way. While bearish September seasonality (especially in the second half) has been absent, this is about the time that stocks feel downward pressure heading into the elections. The chart below shows how the S&P 500 has moved on average during different cycles back to 1928, including the four-year presidential cycle. The composite shows a peak in the S&P 500 during September before pulling back into early November, and subsequently finishing the year strong.

The path of seasonality heading into November elections is also why it’s worth noting the sentiment and market breadth backdrop. Investor sentiment is back at bullish levels according to several measures. That includes CNN’s Fear & Greed Index that’s firmly in “greed” territory, as well as surveys of individual investors. The AAII survey of retail investors shows the ratio of bulls to bears running back near the high end of the historical range. I don’t use investor sentiment alone to evaluate the market outlook, but I pay attention when breadth starts deteriorating. We’ve seen shrinking net new 52-week highs across major exchanges as the S&P 500 moves to new high ground over the past week. And the percent of stocks trading above their 20-day moving average is making lower highs since mid-July as the S&P 500 tests and moves above the 5660 area (chart below).

While I’m not turning bearish on the longer-term outlook, I’m keeping seasonals in mind heading into November as sentiment is very bullish and market breadth is seeing modest deterioration. There hasn’t been a large expansion of breakouts meeting my criteria recently, but recent setups moving out of their basing patterns like APP are holding onto their gains. For this week, I’m removing META from watch as the stock completes its chart pattern. I’m also removing LNW that attempted to breakout (which was not confirmed by the relative strength line) then reversed lower on a court announcement. I have several new additions to the watchlist this week.

Keep reading below for all the updates…

Long Trade Setups

WING

Peaked around $430 back in June, and now retesting that level again. Would like to see one more smaller pullback that creates a MACD hook before trying to breakout. Looking for confirmation by the relative strength (RS) line on a move over $430.

NFLX

Stock touched the $700 level in June. Came back to test that level in early August then traded in a tight range. That reset the MACD at the zero line, with price recently moving over $700 with the RS line at a new high.

CCS

After moving over the $90 level, the stock back tested that area as support while creating a bullish pennant pattern. Moved out from the pennant, but was not confirmed by the RS line. Now back testing the pennant trendline as support.

CYBR

Trading sideways since February while testing resistance at the $280 level on three occasions. Price is now back near the $280 level, and turning higher after a recent pullback that reset the MACD at the zero line. The RS line is also holding near the high.

TAYD

Peaked at the $60 level after moving out of a large base in January. Consolidating gains since April, with the stock moving over an initial resistance level at $53. Now testing the prior high at $60 where I want to see a small pullback before trying to break out.

FG

Broke out of a base back in November and rallied to the $48 area. Consolidating gains since the start of the year and recently rallying back toward $48. Want to see price hold support at the $35 level on any pullback.

Short Trade Setups

F

Rallying off a test of support at the $10 level. That reset the MACD below the zero line, while the RS line has stayed near the lows. Price now making a bearish flag pattern, with support at the $10.45 area. Watching for a break below the flag with confirmation by the RS line at new lows.

Rules of the Game

I trade chart breakouts based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

I also use the RS line as a breakout filter. I find this improves the quality of the price signal and helps prevent false breakouts. So if price is moving out of a chart pattern, I want to see the RS line (the green line in the bottom panel of my charts) at new 52-week highs. Conversely, I prefer an RS line making new 52-week lows for short setups.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on X: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this post.