In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

Signs of investor optimism are emerging alongside more trade deals ahead of the August 1 tariff deadline. The S&P 500 is rallying to fresh record highs following news of a trade deal with Japan and positive developments on a potential agreement with the European Union. That puts the S&P 500 up more than 27% from the early April lows. The S&P has also spent 61 days in a row above its 20-day moving average, which is the best streak since 1998. What’s even more encouraging with recent market action is breadth expansion. The Invesco S&P 500 Equal Weight ETF (RSP) tracks the average stock in the S&P, and is taking out a key resistance level and moving to new highs (chart below).

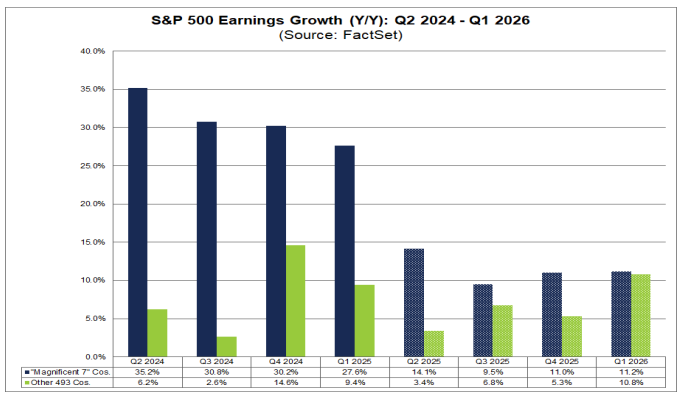

The average company in the S&P 500 will be key to holding the recent gains and building upon the rally. That’s because earnings growth from the “Magnificent 7” is projected to slow considerably, while the other 493 stocks are needed to deliver an earnings boost as the contribution from the Mag 7 moderates. The chart below shows the annual growth rate in earnings by quarter for the Mag 7 (blue line) compared to the other 493 (green line). You can see that Mag 7 earnings growth starts to trail off quickly starting this quarter relative to last year’s pace, while the other 493 are expected to see accelerating growth rates over the coming year.

With further gains, investor sentiment is swinging back to too much bullishness among investors. But as long as breadth is supporting the rally, then the market can keep rising if the foundation supported by the average stock regardless of sentiment. The risk-on environment is boosting several of our positions, including recent additions to the model portfolio. Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.