Welcome back to Mosaic Chart Alerts!

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of fundamentals along with a proper chart setup.

Here are my notes from a focus list of setups I’m monitoring.

Stock Market Update

In last week’s Market Mosaic, I discussed a possible “Goldilocks” scenario unfolding for the stock market. That’s one characterized by an economy currently performing just fine coupled with the Federal Reserve pausing rate hikes to assess the lag effect of policy actions taken thus far. Confirmation of such an environment should be marked by breadth expansion, with more stocks participating in the stock market’s upside compared to the trends of the past couple months.

And that has certainly been the case over the past week. A sudden surge in small-caps and cyclical sectors is resulting in breadth expansion that’s showing up in multiple gauges. We’ve seen net new highs stay in positive territory since the start of June, multiple days with strong advance/decline ratios, plus one other favorable breadth signal. That’s happening with the McClellan Summation Index, where a new positive crossover signal just occurred yesterday as I noted below:

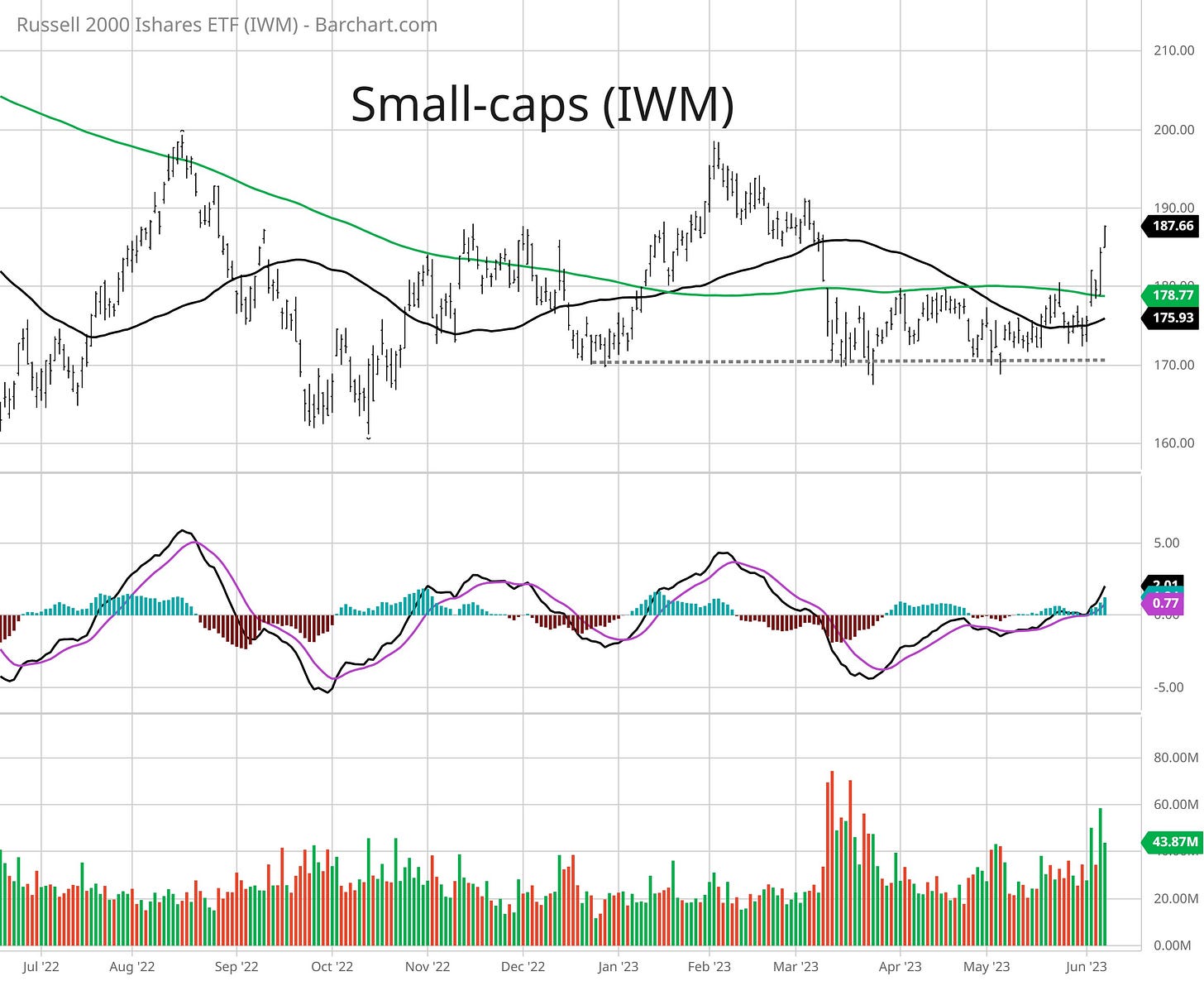

As mentioned earlier, cyclical sectors are also rebounding and showing relative strength. Industrial stocks could be setting up to breakout over a key level that I posted about here, while small-caps are rallying off an important support level to recapture various moving averages. You can see in the chart below that the IWM small-cap ETF is lifting off the $170 support area that’s generating a strong move above the 200-day moving average (green line).

That means I’m finally getting more aggressive in position sizing, and can also be more selective on the best breakout setups. There’s been a proliferation of setups gaining traction, and the key now is to hone on those offering the best potential. One way I do that is by focusing on stocks showing strong sales and earnings growth along with upward revisions to forward analyst estimates. For this week, I’m removing VIPS from the long setups as the stock breaks out over the $16.50 level. I’m also taking KEY and SLG off the short watchlist as recent strength invalidates the chart setup. Finally, I’m adding a couple new ideas to the long watchlist.

Keep reading below for all the updates…

Long Trade Setups

MBLY

Recent IPO trading mostly sideways since February. Gapped lower in April following earnings, but has recovered and testing resistance at the $47 level again. The MACD and relative strength (RS) line in a good position to support a breakout.

LTH

Trading in a tight range since late April, and now just below the post-IPO highs at around $22. Recent consolidation is helping to rest the MACD, where a breakout over $21 resistance could lead to new highs.

SWAV

Price is currently consolidating after another test of the prior highs around $310. The MACD is turning up from zero while the RS line is holding near the highs. Impressive string of quarterly sales and earnings growth.

SKX

Tested the highs from 2021 at the $55 resistance level and pulled back toward the 50-day moving average. The $50 level was also good support from a prior breakout. Looking for a move to new highs.

CIVI

Energy exploration and production company coming up to resistance of this triangle pattern. Watching if price can move above the $75 level followed by new all-time highs.

NOVT

Making a series of higher lows off the October bottom. Recently creating resistance around the $170 level, where a move above could target the prior highs.

NVGS

Trading in a consolidation pattern since last June, creating an ascending triangle. Very volatile price action over the past couple weeks, but will keep on watch for a breakout over the $15 level since it’s still within the pattern.

Short Trade Setups

SPT

Recently testing the $38 support level from last year. The move higher following the gap in early May is resetting the MACD below the zero line, where downside momentum can support a breakdown.

Rules of the Game

I trade chart breakouts based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

I also use the RS line as a breakout filter. I find this improves the quality of the price signal and helps prevent false breakouts. So if price is moving out of a chart pattern, I want to see the RS line (the green line in the bottom panel of my charts) at new 52-week highs. Conversely, I prefer an RS line making new 52-week lows for short setups.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this post.