Welcome back to Mosaic Chart Alerts!

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of fundamentals along with a proper chart setup.

Here are my notes from a focus list of setups I’m monitoring.

Stock Market Update

While this holiday-shortened week has been light on headline volatility and economic reports, seasonal trends keep tracking regardless. The calendar period marking the Santa Claus rally runs through Wednesday next week and is delivering a gain so far for the S&P 500. I also highlighted about a month ago that the period covering Thanksgiving week through the Santa Claus rally is one of the best seasonal stretches of the year. That historic backdrop is supporting the breakout in the Dow Jones Industrial Average to new all time highs, while the S&P 500 isn’t far behind as you can see with the monthly candlestick chart below.

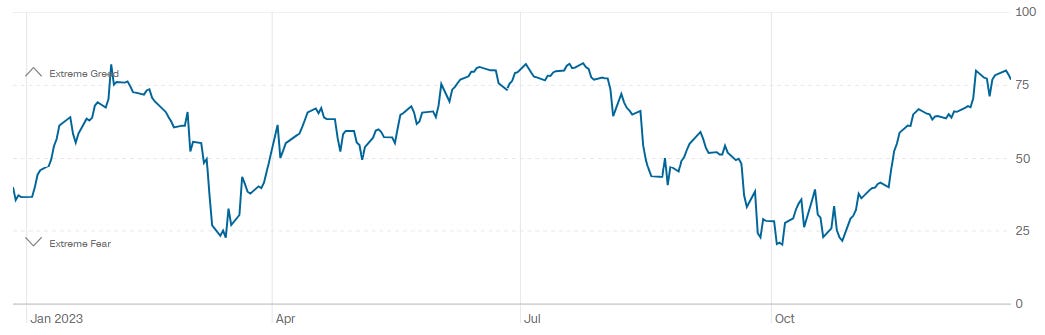

As you would expect, bullish sentiment across various metrics are surging higher. The AAII survey of retail investors shows bullish views at 52.9%, which is the highest level all year. The NAAIM survey that tracks positioning by active fund managers suggests they’re the most invested since the S&P 500 last peaked in July. And CNN’s Fear & Greed Index is firmly in “extreme greed” territory as you can see in the chart below. That’s sparking fears that investors are growing more complacent with greed becoming too elevated, where a sharp pullback is needed to clear out speculative excesses.

But as I noted here, sentiment signals work best when you also detect breadth divergences, and we’re just not seeing bearish divergences yet. A key defining feature of the rally in the stock market since late October is much stronger participation in the trend by the average stock. Another important development as we head into 2024 is the performance of small-cap growth stocks that you can track with the IWO ETF. During past “easy” trading environments like in 2013 and 2017, small-cap growth is in a clear uptrend. You can see in the monthly chart of IWO below that October saw a higher low relative to 2022’s lows while December might see a higher high compared to July’s peak - possibly indicating the early stages of a new uptrend.

Historic seasonal tendencies can keep the rally going into 2024, but I’m not making trading decisions based solely on seasonal patterns. I ultimately follow the stock market’s trend and participation in that trend, and the backdrop is the most bullish we’ve had in quite some time as indicated by the number of stocks making net new 52-week highs across the major stock exchanges. For this week, I’m adding a new trade idea while also removing SPSC from watch as the stock breaks above price resistance to complete its pattern.

Keep reading below for all the updates…

Long Trade Setups

MDB

Basing since July while creating a resistance level around $435. Part of a larger pattern going back to 2022 with a similar resistance level. Recent MACD reset at the zero line. A breakout can target the prior highs around $590.

THR

Broke out over $29 from an ascending triangle at the start of November. Now basing above that pattern and back testing support. Watching for the uptrend to resume with a move above $33.

NVDA

Daily chart creating a resistance level at $500 since August as it consolidates the prior move higher. Recent MACD reset at the zero line now turning higher as the $500 level is being tested again.

RMBS

Recently testing resistance at the prior high around $70. MACD extended on that test, now a small retracement of the rally since October. That's resetting the MACD back at the zero line. Now watching for a breakout over $70 with the relative strength (RS) line at new highs.

URBN

Consolidating prior gains since August, forming a resistance level around $38. MACD resetting at the zero line after recently testing that level again. Expect a breakout to first target the prior highs at $40.

COCO

Trading in a basing pattern since mid-June, with a failed breakout attempt in September. Has traded in a similar range since then, with resistance around the $30 level. The MACD is weakening further, but will keep on watch as long as support around $25 holds.

SYM

Big run over the past few weeks to test resistance around $60. Need to see momentum reset for another move, so ideally the stock trades sideways for a period to reset the MACD at the zero line. If that happens, I would look to buy a breakout to new highs confirmed by rising volume and the RS line at new highs.

MBLY

Made a quick move higher off support around $34. My ideal trade setup is price tests resistance around $45 then does a small retracement of the rally. Look for the MACD to reset at zero in that scenario, followed by an attempt to breakout over $45.

GES

Pulled back after reporting earnings. Will keep on the watchlist for now as long as support at $20 holds. Still watching resistance at $24, which is a level tested several times going back to 2021. Series of higher lows since last October’s bottom. A breakout could target the prior high near $29.

URNM

Uranium stocks could be basing for another move higher. The URNM uranium ETF is recently pulling back after testing resistance again at $50. Now seeing another MACD reset which can help a breakout attempt.

Short Trade Setups

None this week!

Rules of the Game

I trade chart breakouts based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

I also use the RS line as a breakout filter. I find this improves the quality of the price signal and helps prevent false breakouts. So if price is moving out of a chart pattern, I want to see the RS line (the green line in the bottom panel of my charts) at new 52-week highs. Conversely, I prefer an RS line making new 52-week lows for short setups.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this post.

The market breadth is still going strong despite the complacency shown up in AAII as you pointed out :) There is no sign of reversal yet despite the overbought and overextended market.

Managing the position (lock in profit) in this extended market is the priority.

Markets will correct when least suspect. I agree this can last into 2024, it's better to prepare than predict.