Welcome back to Mosaic Chart Alerts!

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of fundamentals along with a proper chart setup.

Here are my notes from a focus list of setups I’m monitoring.

Stock Market Update

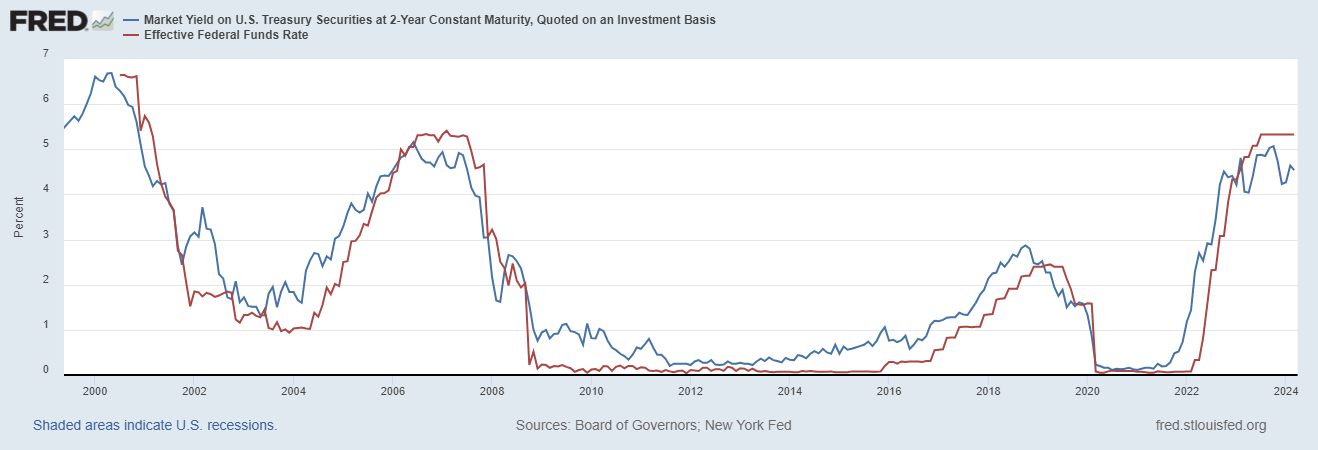

During a light week for the economic calendar and little stock market volatility on the surface, investors are still digesting the aftermath of last week’s Federal Reserve rate-setting meeting. Updated projections showed that the Fed still expects three rate cuts this year despite inflation running above target and ongoing evidence of a strong economy. Market-implied odds for a cut at the June meeting are moving higher once again, and now stand at 70%. The action in the 2-year Treasury yield continues confirming that a dovish pivot in monetary policy is coming. The 2-year yield has remained below the fed funds effective rate, and has led changes in fed funds on several occasions over the past 20 years as you can see in the chart below.

In this weekend’s Market Mosaic, I highlighted several signs that economic activity could start accelerating even as Fed considers easing monetary policy, including slowing the pace of the balance sheet runoff (a.k.a. quantitative tightening) in addition to rate cuts. A macro backdrop marked by a strong economy, rising corporate earnings, and loose financial conditions should be bullish for the stock market. And that’s especially the case for cyclical sectors and other areas of the market sensitive to economic activity. I recently noted positive developments with commodity-linked stocks like copper miners, and now small-caps appear to be resuming the uptrend and key breakout from a bottoming base extending back to early 2022. The chart below shows the IWM exchange-traded fund (ETF) that tracks the Russell 2000 Index of small-cap stocks. After breaking out over the $200 area, price recently came back to test that level as support and is rallying once again.

By some measures, the market action has become somewhat dull. For example, the Volatility Index (VIX) that tracks implied volatility for the S&P 500 is holding near the low end of the historic range. But I find low-vol regimes to be among the best environments for position trading, and utilizing moving averages as stop losses (or as signals to take profits). While there are fewer high-quality breakout setups passing my screens recently, many positions that were breaking out several months ago are still respecting key moving averages. For this week, I’m removing DKNG from the watchlist as the stock breaks out from its chart pattern (the stock is weaker today, but is still respecting the 21-day exponential moving average and basing area that’s now support). I’m also removing LI and MPTI as recent price weakness invalidates the chart setup. I also have several new additions to the watchlist this week.

Keep reading below for all the updates…

Long Trade Setups

NET

Making a series of higher lows since last May as part of an overall bottoming base. Price recently filling a big gap from February, and holding that support level while the MACD resets at the zero line. Looking for a move over $105 followed by $110.

HUBS

Prior watchlist name making a new basing pattern. Creating a “base on base” after moving over the $595 level. MACD resetting at zero while the relative strength (RS) line holds near the high. Watching for a breakout over $650.

DUOL

Recently testing the prior highs around $245. Would like to seeing more basing action following the February gap higher along with an improvement in the RS line. Watching for a breakout over $245.

NXT

After the gap higher through the $50 level, the stock has been trading sideways which is allowing the MACD to reset at the zero line. Now watching for a breakout over the $60 level to new highs.

CUBI

Consolidating the gains after hitting $60 in late December. Would prefer to see the RS line take out the December peak on any breakout attempt. A move over $60 could target the prior high from the start of 2022.

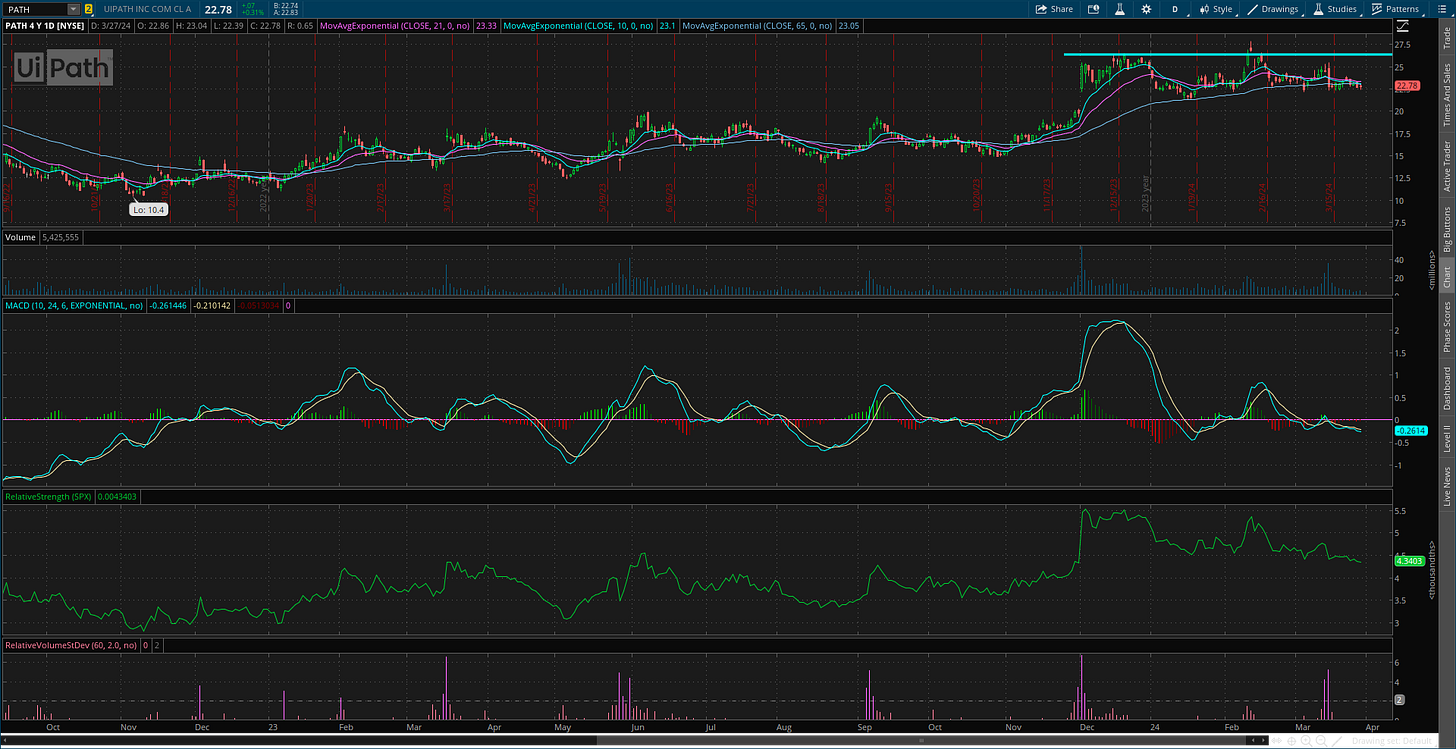

PATH

Attempting to emerge from a bottoming base going back nearly two years. Stock basing since December after breaking out over the $20 level. Don’t want to see support at $21 give way, which would invalidate the pattern. Watching for a move over $27.

STNE

Starting to emerge from a bottoming base going back two years. Took out resistance at $15 and now consolidating the gains. Trading sideways since late December, with a new resistance level near $19. Want to see support at $16 hold in the pattern.

BX

Since peaking back in 2021, the chart has the appearance of a large saucer-type pattern. Price recently nearing the prior high at $140 and now pulling back. That’s resetting the MACD while price holds support at $115. Watching for a move to new highs over $140.

Short Trade Setups

None this week!

Rules of the Game

I trade chart breakouts based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

I also use the RS line as a breakout filter. I find this improves the quality of the price signal and helps prevent false breakouts. So if price is moving out of a chart pattern, I want to see the RS line (the green line in the bottom panel of my charts) at new 52-week highs. Conversely, I prefer an RS line making new 52-week lows for short setups.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on X: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this post.

Hmmmm going to keep a eye on that NET