Mosaic Chart Alerts

S&P 500: Ignore the Headline Noise And Focus on the Price Action.

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup. Live alerts are sent to Traders Hub members only.

Stock Market Update

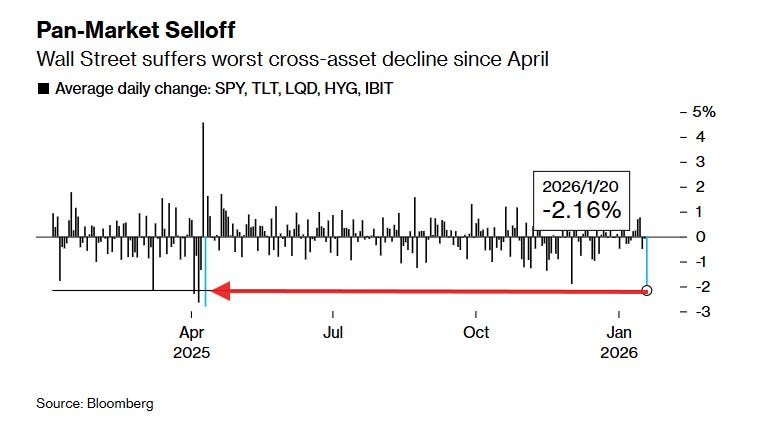

A flurry of headlines and rising tensions between the U.S. and European Union over the fate of Greenland followed a familiar script. President Trump threatened a new round of tariffs that go into effect February (and increase in June) on European nations opposed to his takeover of Greenland. The EU hit back by suspending the trade deal reached last year and threatened to limit U.S. company access to the European market. Escalating tensions drove a sharp selloff in the stock market along with other major asset classes to begin a holiday-shortened week, with stocks, bonds, and cryptocurrencies posting their worst day since the trade war last April (chart below).

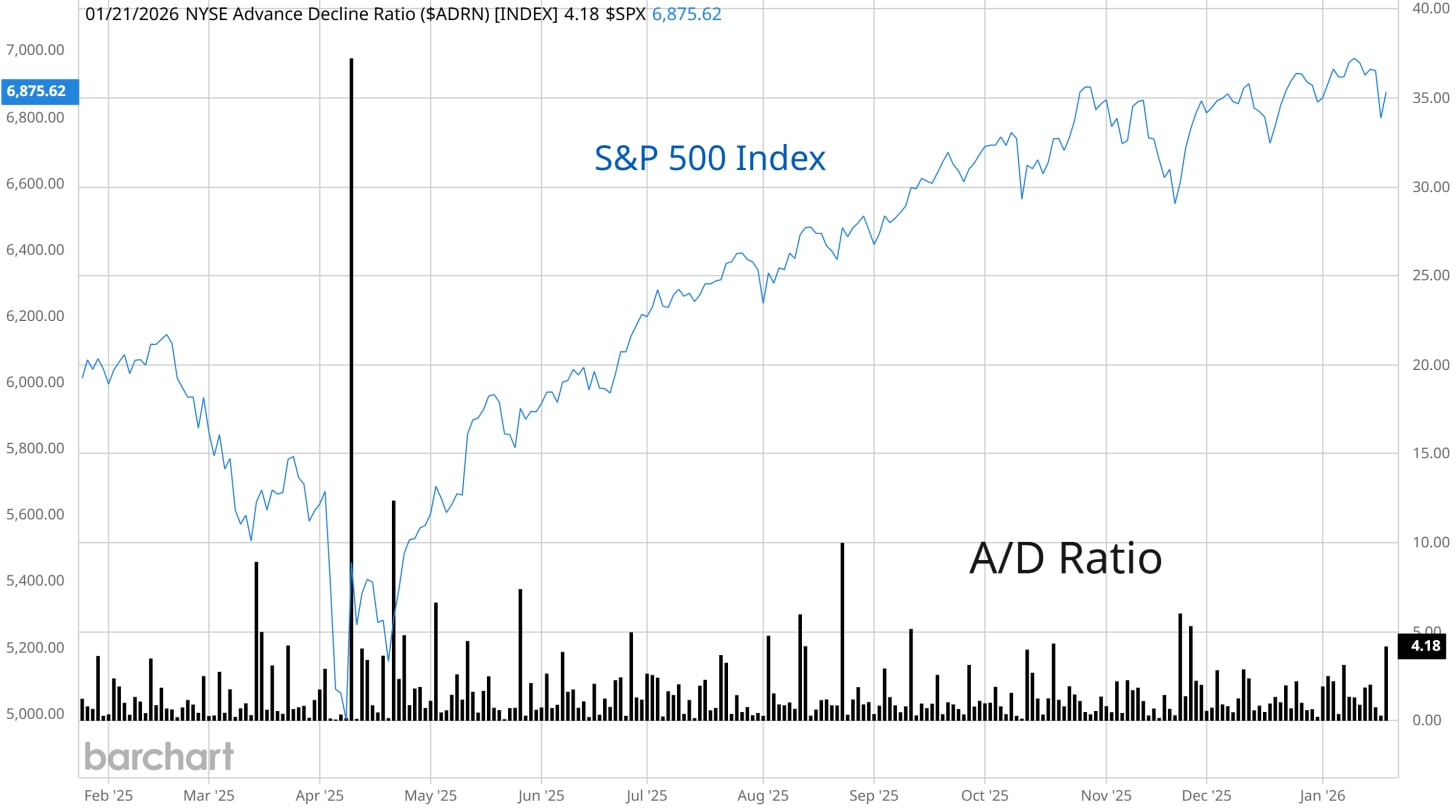

Just when it appeared that investors were facing a jump in volatility, a framework for a deal on Greenland was announced. While details of the deal remain to be seen, Trump did walk back the threat of new tariffs. Stocks responded favorably as investor breathed a sigh of relief that the trade war was not back in full swing. Geopolitical headlines and developments have been proliferating to start the year, which shows the importance of interpreting the message coming from the stock market in order to cut through the noise and make informed portfolio and trading decisions. Breadth has been exceptionally strong to start the year with measures of the average stock making record highs along with key cyclical sectors sensitive to the economy. The rebound in equities following the Greenland deal continues featuring strong breadth, with the NYSE advance/decline ratio coming in at 4 to 1.

Strong breadth on the rally coupled with ongoing loose financial conditions are key ingredients to keep the bull market intact no matter what the daily headlines read. There are also notable sector shifts underway that I’ve shared in the subscriber chat, including infrastructure and energy stocks where we are closely watching new trade setups. Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.