In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

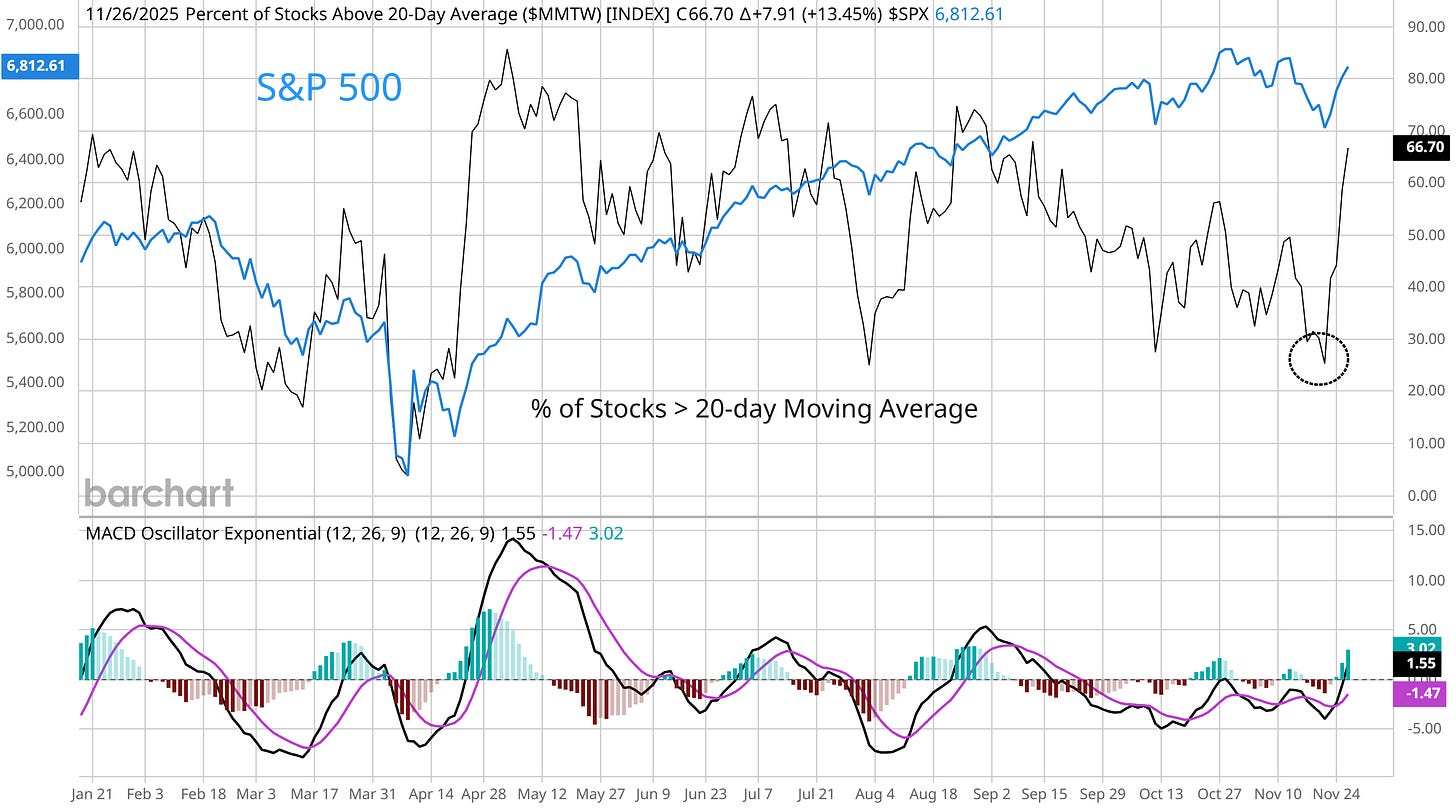

Several catalysts are converging at the same time to help drive a year-end rally for the stock market. With the S&P 500 down 5% off the prior highs at one point last week, numerous signs of oversold conditions emerged. That included the S&P 500’s RSI that fell to 35, which was the lowest level since the selloff into early April around the trade war. Various measures of short-term stock market breadth were among the most oversold levels of the year as well, including the percent of stocks across the market trading above their 20-day moving average (chart below) and the NYSE McClellan Oscillator. At the same time, various measures of investor sentiment showed elevated levels of bearishness.

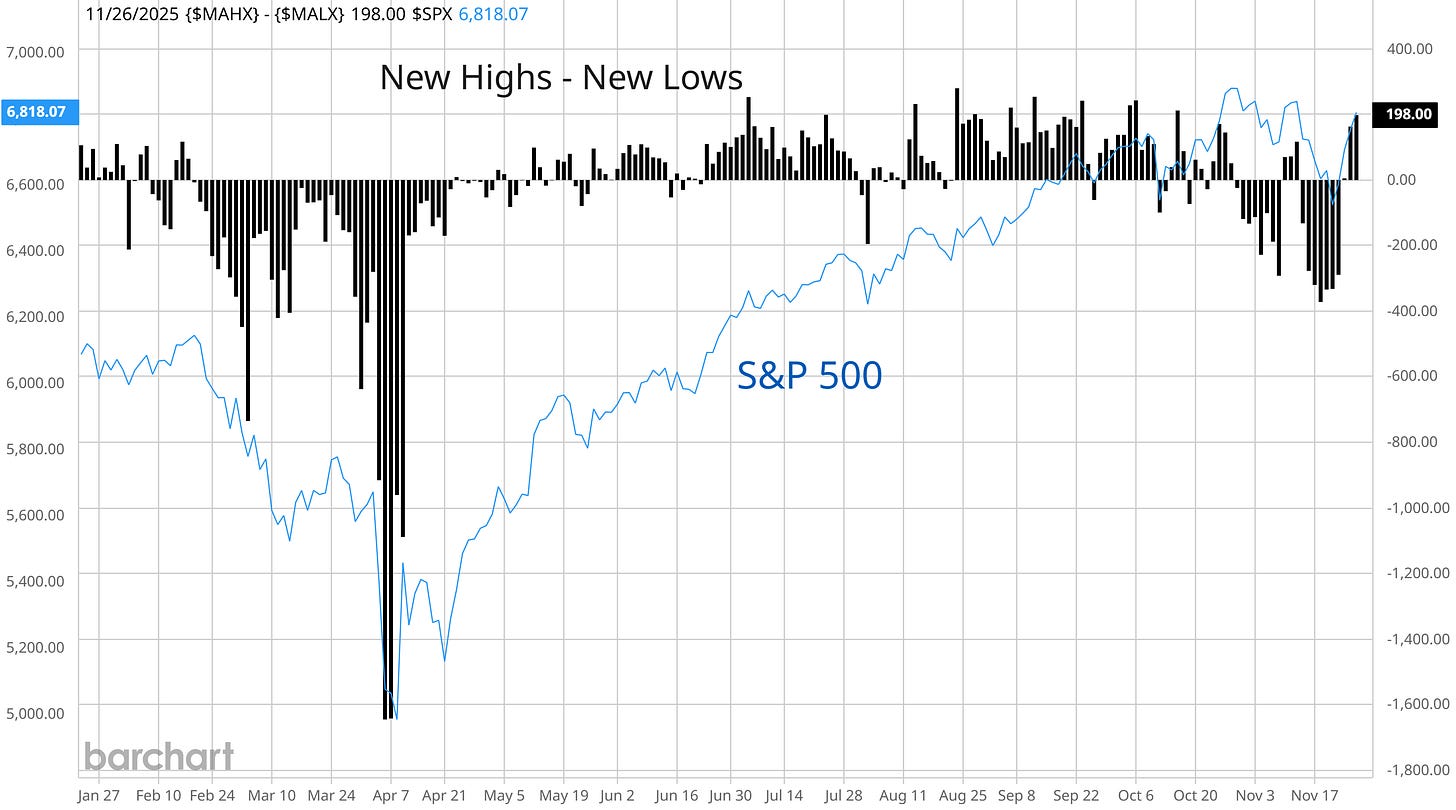

The bullish conditions came together just as the S&P 500 is hitting a stretch of positive seasonality to close out the year. The period just before the start of Thanksgiving in the U.S. through the start of the New Year is a historically strong period for returns. While it may be no surprise that the stock market is rallying this week given seasonals, oversold levels, and bearish sentiment, the strength of participation by the average stock is notable. The market is transitioning back to a regime of net new 52-week highs following a negative breadth environment since the end of October. The chart below shows the difference between new 52-week highs and lows across the major exchanges. After spending most of November with more new lows across the market, net new highs are firmly in positive territory.

Participation by the average stock on the recent advance has been so strong that breadth thrust indicators are close to triggering, including the Zweig Breadth Thrust. Along with more evidence that economic growth remains solid and odds shifting back toward a rate cut by the Federal Reserve in December, conditions are aligned to help support a rally into year-end and deliver a favorable trading environment.

Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.