In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

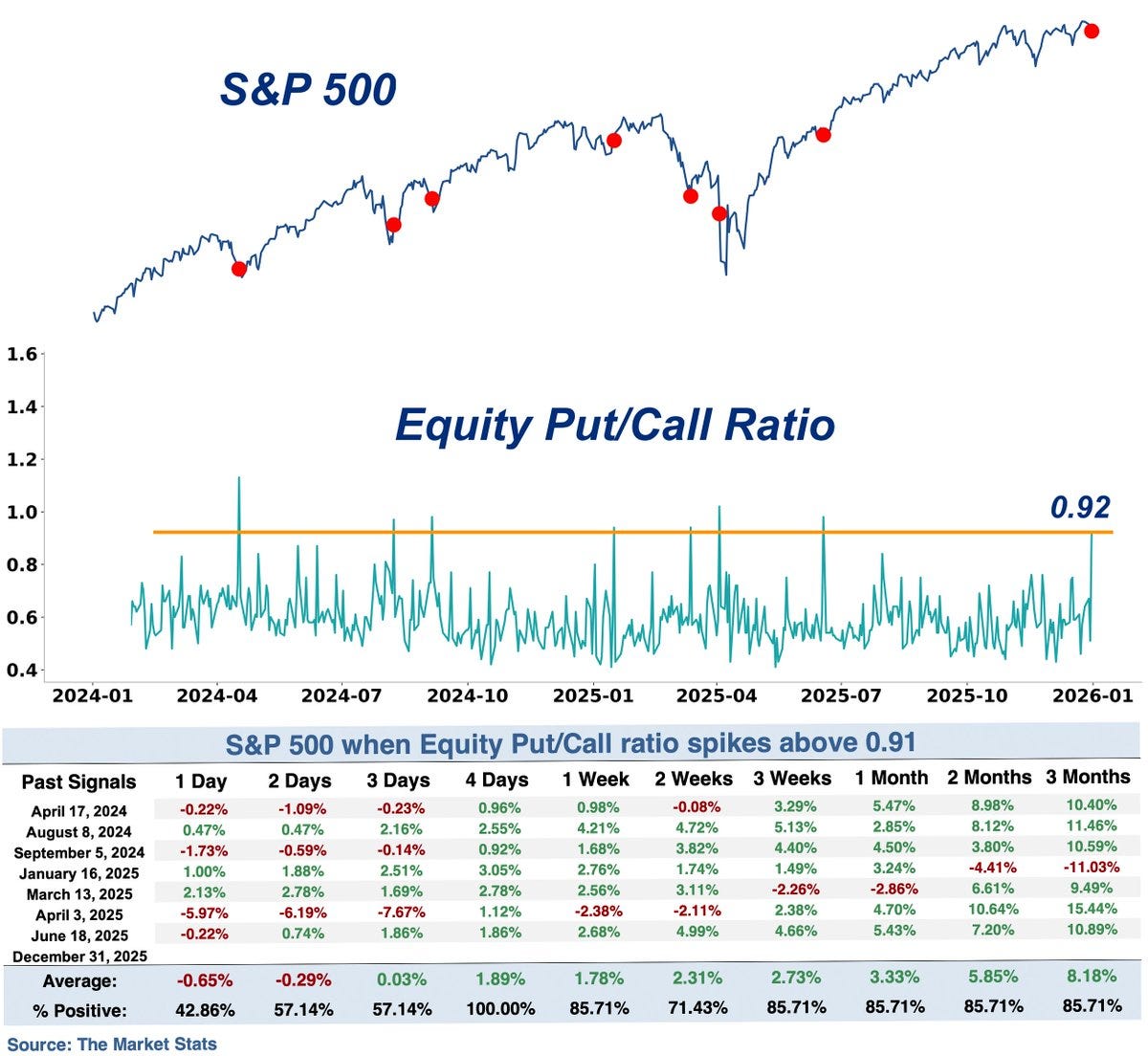

The S&P 500 closed out the final trading sessions of 2025 on a weak note. The index has lost 1.3% over the past week, which coincides with a period marking the historically strong Santa Claus rally. While there’s still two trading sessions left to complete the Santa Claus period, the S&P could potentially finish the stretch with a loss for the third consecutive year in a row, which has never happened before. If anything is going to save the Santa Claus rally, it could be a short-term spike in bearish option positioning. The ratio of put volumes relative to call volumes spiked on the last trading day of the year to .92 (chart below). That level shows bets on downside reaching an extreme, which historically has seen the S&P deliver strong gains on average in the days ahead.

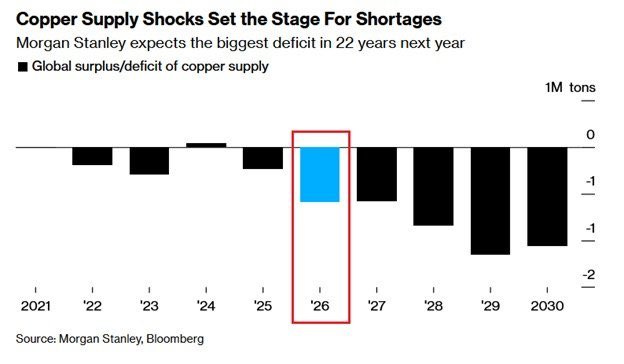

While the major market indexes finished out 2025 on a weak note, the full year experienced another round of solid gains. The S&P 500 finished the year up 16% while the Nasdaq rallied by 20%. But I believe it’s the action in other corners of the capital markets that deserve more attention and will remain key themes driving stock market volatility in the year ahead. For instance, the U.S. Dollar Index had its worst return in eight years, while gold and silver went on to gain 64% and 150% respectively. Copper is also breaking out from a multi-year ascending triangle base, and increased 43% on the year. At the same time, Morgan Stanley is forecasting that 2026 will experience the largest copper supply deficit in 22 years (chart below). Since precious metals and commodities like copper have high inflation betas, that’s a warning on the inflation outlook as we head into the New Year.

I’ll have more to say on my outlook for 2026, which I believe could feature a major market peak if a worsening inflation picture jeopardizes the outlook for monetary policy and sparks bond market volatility. But for now, the backdrop remains very constructive for trading breakouts in high growth themes and industries. Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.