Mosaic Chart Alerts

A confluence of resistance levels and deteriorating breadth pressures the S&P 500; short setups close to breaking down.

Welcome back to Mosaic Chart Alerts!

In this newsletter, I’ll focus on the best setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the result of my process to identify stocks offering the right combination of fundamental attributes along with a proper chart setup.

Here are my notes from a shortlist of setups I’m monitoring.

Stock Market Update

When Federal Reserve Chair Jerome Powell signaled a pivot to slower rate hikes one week ago, it looked as if the stock market would keep building on the rally that unfolded in mid-October. But a confluence of resistance levels and weakening trends has stopped the stock market in its tracks this week. First, the S&P 500 was testing the 200-day moving average, which is a resistance level that thwarted the prior rally into mid-August. And the same chart area coincides with trendline resistance going back to the peak in the S&P. You can see both resistance points in the chart below.

But there is one other big red flag, and that is breadth deterioration. You could especially see that with the percent of stocks trading above their 20-day moving average. I use that metric to gauge how many stocks are in short-term uptrends, and that figure shrunk even as the S&P rallied higher into last week. That’s something I recently highlighted here in Mosaic Chart Alerts and updated here on Twitter. It appears that the weakening foundation finally gave way to a pullback.

Due to the deteriorating trends, I haven’t done much trading for the past couple weeks. That means I’m sitting on a heavy cash position as I wait for setups to play out. Most long setups aren’t breaking above levels that would trigger a trade, while I’m going to remove CVI from our long ideas due to its price breakdown below the 50-day moving average. At the same time, short setups are becoming more compelling if we see the downside play through. Several stocks on watch are sitting right on key support levels, and I have a new addition as well…keep reading for updates below.

Long Trade Setups

KEYS

Broke out over the $180 resistance area noted last week, and now back testing support. Want to see the trendline level and 21-day EMA hold on this test.

ARCH

Trading in a consolidation pattern since April. Starting to show signs that another breakout could be developing. Watching for a move over the $165 level.

RNGR

Price resistance around the $11.50 level tested several times over the past 16 months, and could now be setting up a key breakout. The MACD is resetting at the zero line; also want to see the 50-day MA hold here. A more speculative smaller-cap name, so position size accordingly.

NSP

Basing pattern going back a year creating resistance level at $120. Prefer to see the $110 level hold while it trades within the pattern.

AMN

Ascending triangle pattern that has developed over the past year. Nearing the apex with resistance around $129. Don’t want to see trendline support lost while trading in the pattern.

Short Trade Setups

HA

Testing support of this triangle continuation pattern. Looking for a close under $13 as a trigger level.

CUBI

Crypto-linked bank broke down from the bear flag pattern highlighted for the past couple weeks. Now sitting right on the September low.

AMZN

Price previously tested the $105 breakdown point. Took out the $90 trigger level this week; next support level is the November low at $86.

W

Backtested trendline support around the $45 level twice. A move above trendline resistance would invalidate the pattern. Next minor support is recent low at $28.

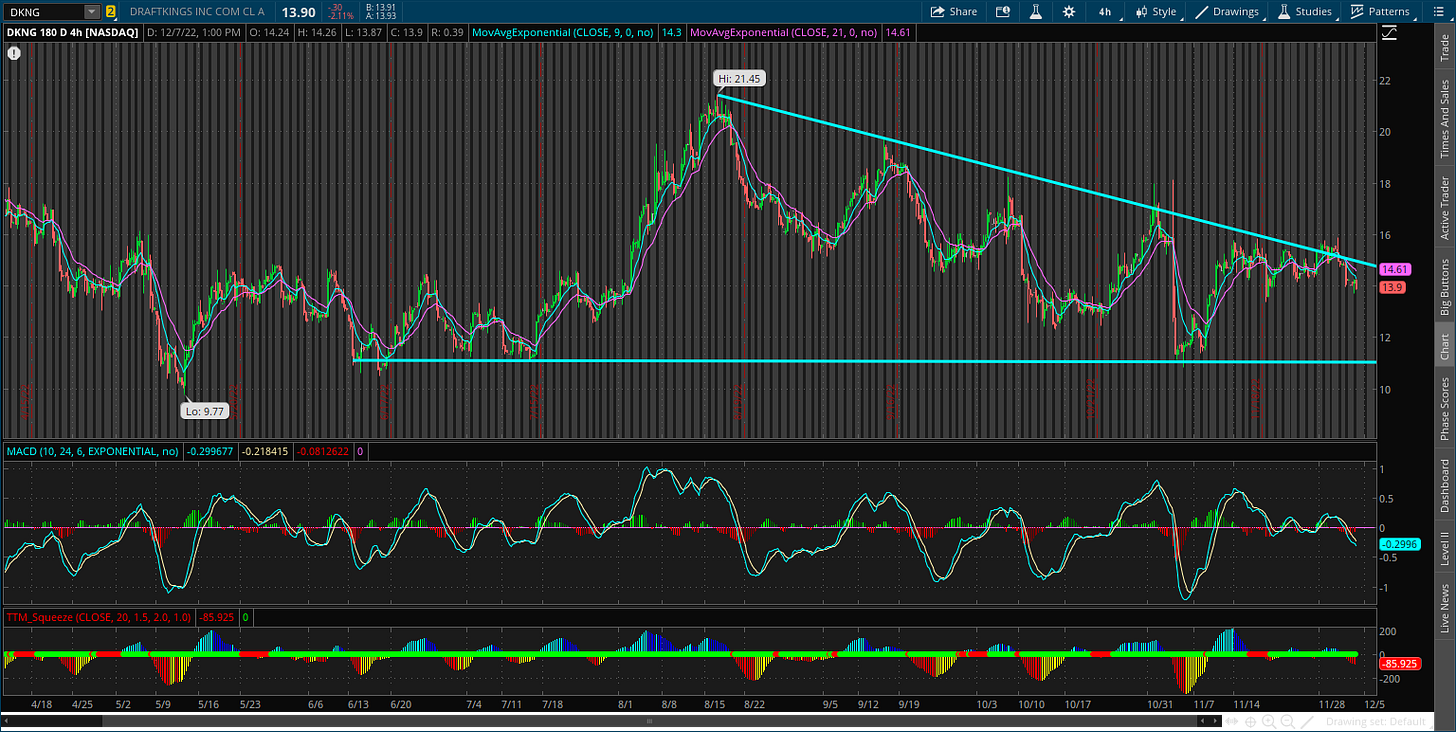

DKNG

Stock has tested the $11 support level several times since rebounding off the lows in May. Keeping on watch as this descending triangle pattern develops. A move above trendline resistance would invalidate the setup.

Rules of the Game

If you haven’t noticed yet, I trade breakouts! I trade based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.