In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

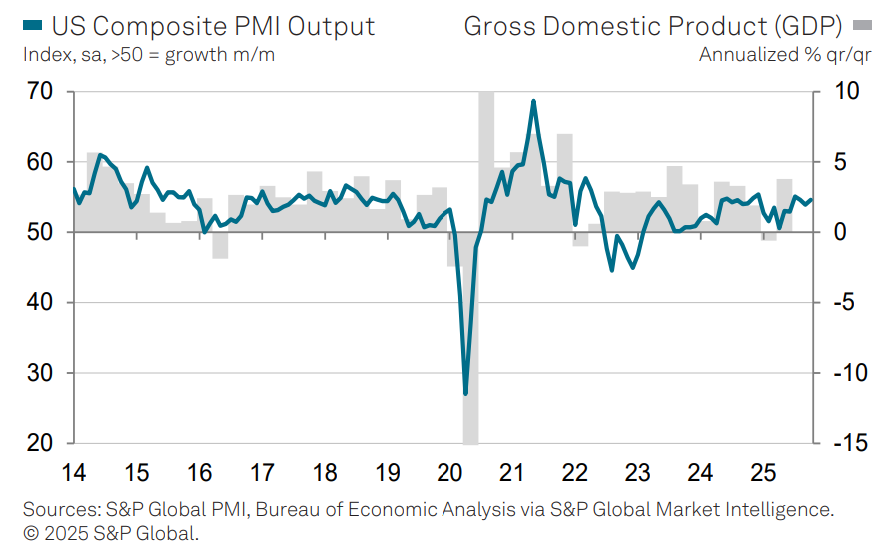

The current U.S. government shutdown is now the longest in history, which is also continuing to delay the release of key economic reports. But recent data from private sector companies paints a solid picture for the economy. The ADP report on private sector payrolls showed the addition of 42,000 jobs in October, which was better than expected and compares to September’s loss of 29,000. Another report from the Institute for Supply Management showed service sector activity expanding in October while the new orders component surged to 56.4. A reading above 50 indicates expanding activity, with new orders considered to be a leading indicator. S&P Global’s US Composite PMI rose to 54.6 (chart below) which was driven by increasing activity in both manufacturing and service sector output. S&P’s PMI is holding near the high end of readings over the past few years.

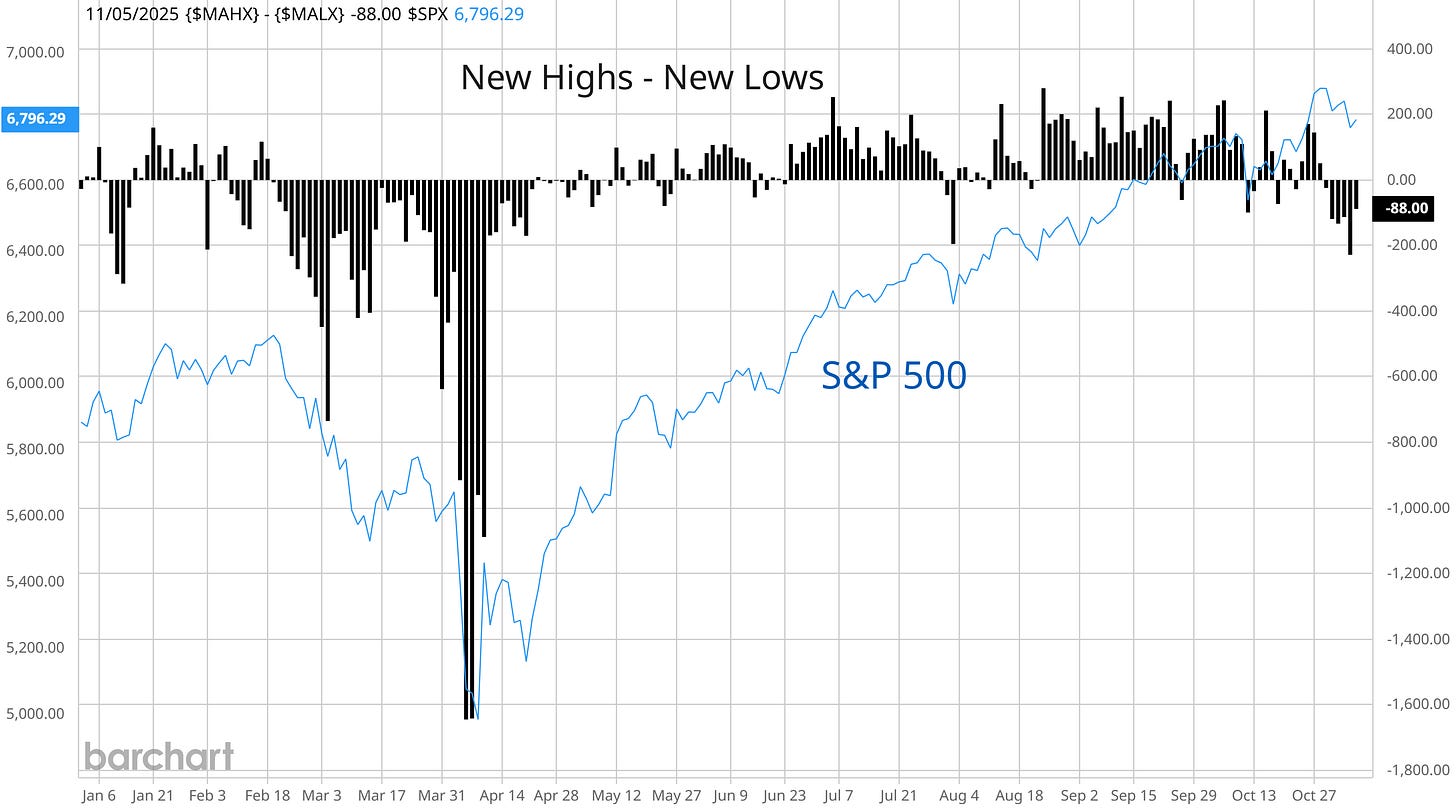

Just as recent private sector reports indicate solid economic activity, companies in the S&P 500 are also delivering a historically strong earnings season with better than average beats on both the top and bottom line. Stock prices ultimately follow earnings over the long run, but in the near-term there are signs of weakness under the hood. The chart below plots new 52-week highs less 52-week lows across the major stock exchanges. Since the end of October, the market has shifted to a regime of net new 52-week lows despite the S&P 500 holding near the highs.

The combination of positive economic data, recent rate cuts by the Federal Reserve, and loose financial conditions means that the bull market should make more progress into next year. But even the strongest bull market’s experience pullbacks and drawdowns along the way. One positive aspect of choppy price action under the hood means that new basing patterns are forming, and new leaders can emerge.

Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.