In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

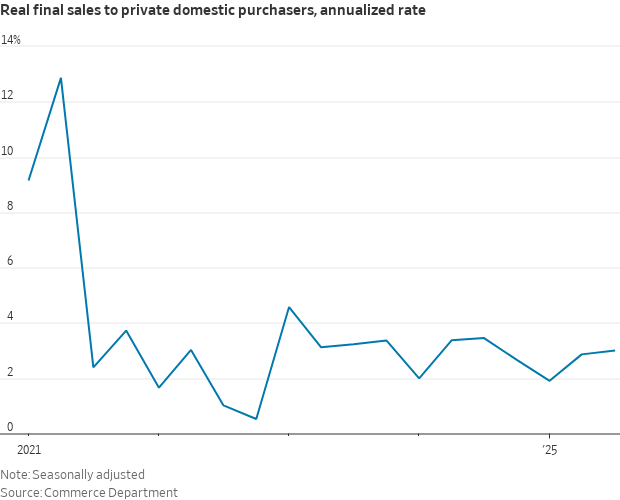

An updated look at GDP shows economic activity is holding up much better than economist forecasts. Third quarter GDP grew at an annualized rate of 4.3% compared to expectations for a gain of 3.2%. Within the report, real final sales tends to be a better gauge of underlying demand and accelerated by 3.0% (chart below), which was the strongest gain in a year. The Atlanta Fed’s GDPNow estimate is currently pointing to fourth quarter GDP growing at a 3.0% annualized rate. Along with jobless claims that remain near the low end of the historic range, incoming data points to an economy showing solid growth.

Strong economic activity should be reflected in cyclical sectors and areas of the market leveraged to domestic growth like mid- and small-cap stocks. Breadth continues to track favorably while growth stocks exposed to the artificial intelligence (AI) trade are weighing on the capitalization-weighted indexes like the S&P 500 recently. Growth stock valuations are also more vulnerable to the outlook for interest rate cuts by the Federal Reserve, which is in question following strong economic data. A rotation that boosts cyclical sectors and the average stock is a positive condition heading into 2026 following the heavy lifting by Magnificent 7 stocks and the AI trade.

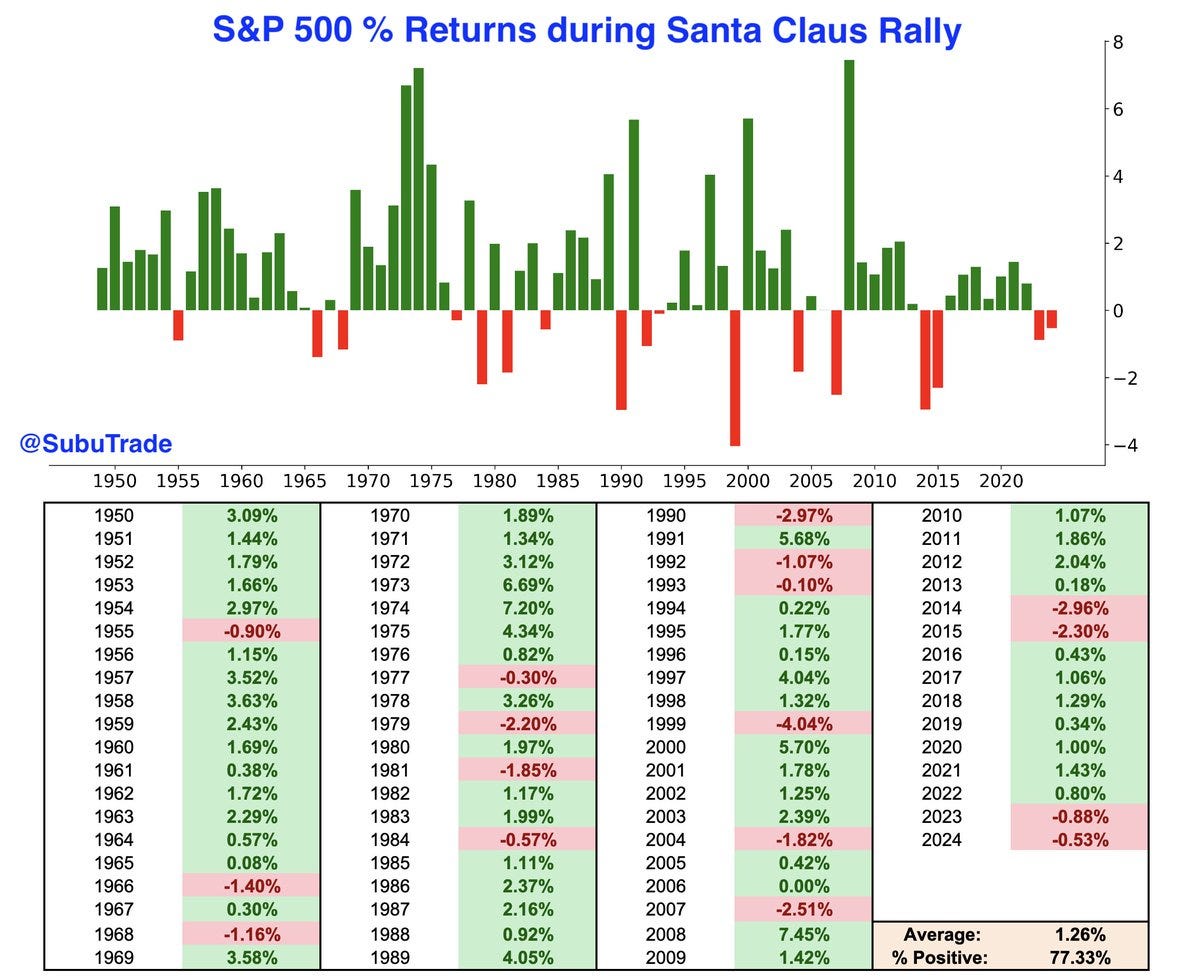

The stock market also remains within a favorable seasonal period, including the Santa Claus rally over the near-term. That period marks the final five trading sessions of the year along with the first two days of the New Year. Going back to 1950, the Santa Claus rally has delivered a positive return 77% of the time with an average gain of 1.26% for the S&P 500. It’s notable that the last two years have seen negative returns during the period, and that there’s never been a stretch of three negative years during the Santa Claus rally period (chart below).

Another feature of recent market action is in precious metals, with both silver and gold building on record highs which is boosting several of our positions. We’re now holding three positions leveraged to precious metals that are currently up 100% or more. I’m also tracking new setups in several growth sectors that are showing strong basing patterns. Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.